To access the carrier product and rate information provided by PRISM, check the box below indicating you have read and agree to the license agreement. A button will then appear to access PRISM.

This site uses cookies to track your agreement option. If the terms of the license agreement change or if you clear the cookies from your browser, this page will appear once again during the PRISM login process.

New Cigna + Oscar (C+O) small group sales and renewals will not be offered in 2025. At C+O’s request, all plans and rates have been removed from the quote engine. However, you can still quote or renew your C+O groups through December 15, 2024 by contacting us at quotes@claremontcompanies.com or 800.696.4543. Please note: the last day of coverage will be December 14, 2025.

For assistance, please contact our Quotes team at quotes@claremontcompanies.com or 800.696.4543.

Login To PrismNo, that’s incorrect. Covered California for Small Business is a health insurance marketplace that offers any California small business (1-100 employees) a choice of quality, affordable health insurance from multiple trusted carriers.

A wide range of California employers benefit from the many advantages offered by Covered California for Small Business. Discover the advantages here.

Per Section 6526 and pursuant to Health and Safety Code 1357.504 (d) and Insurance Code Section 10753.06.5 (d), once coverage is approved and effectuated, the employer can exercise the right to change coverage with the same carrier within the first 30 days. Other changes, such as requesting to change from one carrier to another, requesting to add dental, requesting to add members/dependents, are evaluated as an exception.

Mid-year enrollment changes should be communicated using the Covered California for Small Business Change Request Form for Employees.

The Affordable Care Act does not require small employers to offer health care coverage. Employers with 1-100 eligible employees will not be subject to penalties for not providing health coverage. Small employers that do offer coverage are not required to get it through Covered California for Small Business, they can purchase coverage inside or outside of the Exchange. However, eligible small businesses can secure the small business tax credit only if they purchase coverage for their employees through Covered California for Small Business.

The total employee premium for the lowest cost plan in the selected tier is paid by the employer as a percentage contribution. Let’s say that a 10 life group has a $2500 monthly employee premium for the lowest cost plan at the selected metallic level. The employer contribution is 50%. The employer responsibility would be $1250 or 50% of the total employee premium. As we have an age based rating methodology that premium would represent 50% of each employee premium at every age band. So a 65 year old would get more money that a 25 year old but they would each receive a contribution of 50%.

SBCs for the Covered California for Small Business plans can be found here.

The group would need at least one W2 non spouse employee to be an eligible group.

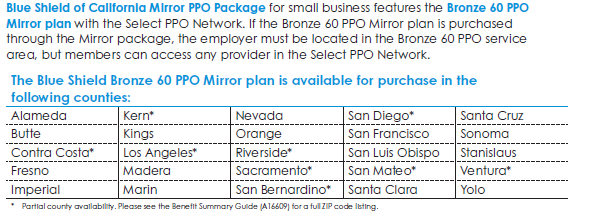

The Blue Shield Bronze PPO 60 plan, with out-of-state coverage through the Blue Card, is available to out-of-state (OOS) employees IF the employer is located in the service area where the plan is offered. Below is the list of counties and/or partial counties where the Blue Shield Bronze PPO is offered.

Normally, employers can only offer two tiers of coverage (Silver and Gold, for example), however, if an employer located in one of the above service areas needs to accommodate OOS employees, Covered California for Small Business (CCSB) will permit the employer to offer the Blue Shield Bronze PPO 60 to OOS members. If the employer is not located in one of the above service areas, then other coverage would need to be considered for these employees. For instance, the employer can opt to offer the eligible OOS employee coverage through the SHOP in that employee’s primary out-of-state worksite.

Note: CCSB had sold plans from Health Net that provided coverage to OOS members, however, in April 2016 Health Net announced that they would no longer cover OOS members. For groups that have existing OOS members on the Health Net plan, they can stay on the plan until the group comes up for renewal. For groups that did not have existing OOS members, they would not be able to add any OOS members after April 2016 so other coverage would need to be considered.

At the group’s renewal, the OOS members do have the option to move to the Blue Shield Bronze PPO 60 plan IF the employer is located in one of the service areas where the plan is offered (see above).

A three-person group where two are partners and one is a 20-hour/week employee (who’s not the spouse of either partner) is a group eligible for Covered California for Small Business if the group offers coverage to that employee.

If the group does not offer coverage to that employee, then it would not be eligible for Covered California for Small Business coverage.

The rule is that at least one eligible employee must be extended coverage. An employee that averages 30 hours/week or more is considered eligible automatically as a full-time employee. A part-time employee that works 20-29 hours/week is considered eligible only if the employer extends an offer of coverage to part-time employees that work 20-29 hours/week.

Employees that work less than 20 hours/week or are 1099 or are seasonal are not eligible.

Employers can apply in the following ways: