To access the carrier product and rate information provided by PRISM, check the box below indicating you have read and agree to the license agreement. A button will then appear to access PRISM.

This site uses cookies to track your agreement option. If the terms of the license agreement change or if you clear the cookies from your browser, this page will appear once again during the PRISM login process.

New Cigna + Oscar (C+O) small group sales and renewals will not be offered in 2025. At C+O’s request, all plans and rates have been removed from the quote engine. However, you can still quote or renew your C+O groups through December 15, 2024 by contacting us at quotes@claremontcompanies.com or 800.696.4543. Please note: the last day of coverage will be December 14, 2025.

For assistance, please contact our Quotes team at quotes@claremontcompanies.com or 800.696.4543.

Login To Prism

According to the recently released Ease 2023 SMB Benefits and Employee Insights Report, that focuses on the evolving benefits landscape for businesses with 1-250 employees, the smallest businesses are seeing the biggest medical premium increases. The report also offers insights into the benefits pressures employers and employees face and shares data to help you and your clients make informed decisions for the coming year.

With anonymized data collected from more than 2,300 health insurance agencies, 85,000 businesses, and 3.4 million+ employees nationwide that use Ease, the Report found medical premiums continue to climb, employees today expect their organizations to recognize their lives inside and outside of work, and employers and employees are asking more and more of each other.

A cooling job market, hints of a coming recession, unclear return-to-office plans, supply chain disruptions, and inflation, will continue to be challenging for small-to-medium businesses (SMBs).

Brokers who succeed will be the ones who stay out in front and offer benefits that matter to their clients – all while keeping an eye on the bottom line. To do this, they must rely on data-driven insights to learn from what’s come before and what could come next.

You’ll Find Features Insights and Trends On:

Medical premiums are experiencing cost increases much like everything else. Since 2018, individual premiums saw a 21% increase, while family premiums have a slightly lower increase at 17.87% over the same time period. That’s a $104 per month increase for individuals and a $231 per month increase for families — or $1,248 and $2,772 per year — significant for any household.

While the jump in average premiums from 2021 to 2022 fell under the 6.5% rate of inflation, the smallest employer groups were dealt the hardest blow. Employers with only 1-10 employees saw an increase of 12.07%. That’s nearly double the rate of inflation and the largest increase this segment has experienced in the past four years.

Continuing the trend seen since 2018, the smaller the company the more their employees paid toward benefits. Employees working for companies with 101-250 employees paid 37% less than those working for companies with 1-10 employees this past year.

When it comes to plan-type adoption, HMOs and PPOs remain the most popular choice for employees, more than 50% of SMB employees opted to waive coverage entirely, up 13% from 2020.

Though the uptake of consumer-driven health plans remains a small slice of the pie, participation in High Deductible Health Plans (HDHPs) has increased 68% year-over-year. Panning out, HDHPs typically combine with a Health Savings Account (HSA). Given the current state of the economy, households may be opting to use higher deductible plans to save money on their monthly premiums in spite of the higher financial risk if a major medical event occurs. More money in their pockets each month seems like a safer bet.

On average, businesses with more employees offered more medical plans than those with fewer employees in 2022.

Non-medical voluntary benefits offer SMBs a unique way to meet the needs of their employees without destroying their budgets. Must-haves like dental, vision, and life top the list for SMB employees, but lifestyle benefits like financial wellness, legal services, and pet insurance continue to gain steam.

Vision coverage continues to see a decrease year-over-year in premium cost. Short-term disability saw the biggest jump from 2020 to 2022 at almost 12% ($2.75 per month, or $33 more annually).

Similar to the trend seen with medical plans, the larger the company, the more voluntary benefits plans offered per employee in 2022.

Groups in Ease experienced a nominal increase in the average number of employees. While all segments have seen a small uptick in employees from 2021 to 2022, all fluctuations are within one point when looking at a three-year trend line. Outside of Ease, SMBs experienced a net job loss of 3 million,* or a shrinking of 5% of the total workforce.

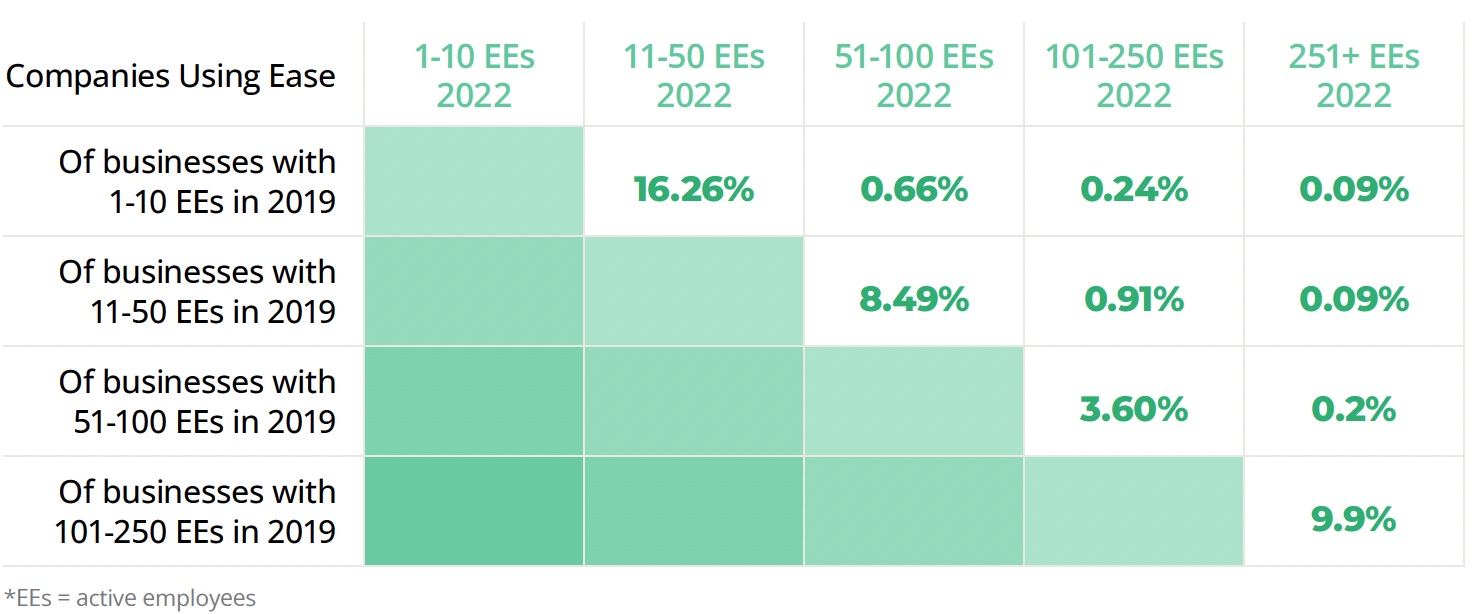

Ease looked at companies using their system since 2019. Overall, 13.29% of companies using Ease grew, while 7.68% shrank over the same period.

By using the data from Ease’s survey of 1,000 U.S.-based employers and employees, you’ll be able provide options and ongoing management support year-round to recession-proof your business.

Employers (ERs) and Employees (EEs) top benefits priorities in 2023:

Employer expectations for year-round support continue to increase. In fact, only 6% of employers surveyed think their broker is needed only during open enrollment. That means 94% expect consultation, innovation, and ongoing management support year-round.

37.52% of agencies offered more support to clients this year than last year by helping them onboard new hires online, conducting benefits elections remotely, and providing compliance support.

78% of agencies anticipate their groups wanting more insurance options this upcoming enrollment season:

73.77% of employers believe benefits administration technology is a higher or equal priority going into this year’s open enrollment.

For a deeper understanding of the latest employee benefits trends and to better advise your clients, download the Ease 2023 SMB Benefits and Employee Insights Report.

Ease is an online benefits enrollment system that makes it simple for insurance brokers and small business employers to set up and manage benefits, onboard new hires, stay compliant, and offer employees one destination for all their human resources information.

The Ease Marketplace is equipped with products, technology solutions, and resources to help you stay ahead of industry trends, defend against new competitors, and build a robust HR offering.

Don’t have an Ease account?

Contact us for free Ease online enrollment for your groups with one line of coverage or more.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

*U.S. Small Business Administration Office of Advocacy, 2022 Small Business Profile Infographic