To access the carrier product and rate information provided by PRISM, check the box below indicating you have read and agree to the license agreement. A button will then appear to access PRISM.

This site uses cookies to track your agreement option. If the terms of the license agreement change or if you clear the cookies from your browser, this page will appear once again during the PRISM login process.

New Cigna + Oscar (C+O) small group sales and renewals will not be offered in 2025. At C+O’s request, all plans and rates have been removed from the quote engine. However, you can still quote or renew your C+O groups through December 15, 2024 by contacting us at quotes@claremontcompanies.com or 800.696.4543. Please note: the last day of coverage will be December 14, 2025.

For assistance, please contact our Quotes team at quotes@claremontcompanies.com or 800.696.4543.

Login To PrismWe’re excited to be an exhibitor at the upcoming Ease EIC21 — the digital conference for growing agencies.

During this free two-day event, get impactful content and actionable takeaways not found anywhere else. Plus, hear from the industry’s foremost thought leaders, paired with members from the Ease leadership team, to learn unique insights and strategies that will help you innovate, grow revenue, and increase customer service.

What to Expect

Event Details

Questions?

Contact our small group experts at 800.696.4543 or info@claremontcompanies.com.

Date: April 29, 2021

Time: 12:00 pm PDT

Place: Online

Cost: Free

Presenters: David Norton and Rhonda Hollier from HR Service, Inc.

With more details on the American Rescue Plan Act, new compliance requirements, relief aid for small businesses, and more to come, business leaders need to be aware of critical changes for compliance and the steps needed to receive assistance.

Get an in-depth look at these changes and the required employer actions to provide answers to these questions and more. Plus, get updates on the additional stimulus relief coming from the Biden Administration.

Topics Include:

Register for the April 29th webinar today!

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Dates/Times: May 5, 2021 at 10:00 am PT or May 11, 2021 at 12:00 pm PT

Place: Online

Cost: FREE

Technology is changing the world and companies are changing with it. Are you ready to meet their needs? The role of the broker is evolving to face new challenges and provide unmatched service to clients.

In this webinar, Ease CEO and Co-Founder, David Reid sheds light on the future of the insurance industry and shares how technology can help you stay competitive. Is your agency ready to face the industry’s challenges?

Register for the Ease webinar on May 5th at 10:00 am PT or May 11th at 12:00 pm PT.

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

The American Rescue Plan, signed into law on March 11 2021, provides a 100 percent COBRA premium subsidy – between April 1, 2021 and Sept. 30, 2021 – for individuals whose reduction in hours or involuntary termination of employment makes them eligible for COBRA continuation coverage during this period.

The administration of the COBRA subsidy includes requirements of employers, plan sponsors and COBRA administrators, who will need to take prompt action to ensure compliance. Brokers will want to familiarize themselves with the new subsidy and the requirements of employers.

Employers that provide coverage subject to federal COBRA law should consult their COBRA administrator. Claremont can assist brokers looking to partner with a COBRA administrator.

Employers that provide coverage subject to Cal-COBRA law should look out for information being provided by their medical carriers. Brokers should do the same. Claremont can help brokers find answers to questions they may have.

Below are several helpful resources that will assist brokers and employers navigate the new subsidy.

Have questions? We can get the answers. Our partners, Benefit Resource Inc. (BRi), TASC, and BASIC all specialize in COBRA administration.

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

LAAHU’s Annual Symposium is the largest in the state and includes updates from D.C., breakout sessions for Wellness & Mental Health, Technology, Compliance, and Small & Large Employers. Once again, this will be the premier networking and educational gathering of insurance professionals in Southern California.

About Commissioner Lara:

Raised in East Los Angeles by immigrant parents, Commissioner Ricardo Lara made history in 2018 by becoming the first openly gay person elected to statewide office in California’s history. Commissioner Lara previously served in the California Legislature, representing Assembly District 50 from 2010 to 2012 and Senate District 33 from 2012 to 2018. Commissioner Lara earned a BA in Journalism and Spanish with a minor in Chicano Studies from San Diego State University.

For more information visit laahu.org or contact them at 800.676.1628 or info@laahu.org. Register now.

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

According to the 2021 State of HR Survey, conducted by ThinkHR from October 12, 2020, to November 9, 2020, responses from 2,200 professionals revealed small-to-medium employers were still dedicated to the health and well-being of employees, even after a tumultuous year with countless human resource and compliance challenges.

ThinkHR’s 2021 State of HR Report dives into employers’ challenges with understanding and complying with laws and regulations that hindered their ability to focus on their employees, in addition to their need for help with complex issues and administrative burdens.

Gain more insights into what small-to-medium businesses are thinking this year by downloading the 2021 State of HR Report.

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

The Paycheck Protection Program (PPP) was reopened on January 11, 2021 with updated eligibility requirements and the possibility of a second loan for the hardest-hit small businesses. The new guidelines make it easier for businesses to obtain a first-draw PPP loan and a second-draw PPP loan to be used for eligible payroll and non-payroll expenses, including technology. Software and cloud upgrades, for example, are recognized as critical expenses, potentially including payroll, HR, and HCM platforms to digitize operations and support touchless, mobile-friendly solutions.

The PPP loan application deadline is March 31, 2021.

With the continued closures and operation restrictions, businesses have been forced to adapt and stretch resources to stay open. The good news, as of March 14, 2021, more than 7.8 million PPP loans had been approved, providing over $703 billion in relief. Unfortunately, lockdown and work-from-home measures brought about by COVID-19 have disproportionately affected small businesses – particularly in the leisure and hospitality sectors. And nearly a quarter of all small businesses (fewer than 500 employees), which employ roughly half of the country’s workforce, remain closed.

According to the Congressional Research Service, unemployment during the pandemic peaked in April 2020 at 14.8% and remained at a still-elevated 6.7% in December. With support from the Department of Treasury, the Small Business Association (SBA) originally began providing funds via the PPP program in March 2020 as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The Consolidated Appropriations Act of 2021 (CAA), signed into law in December 2020, provided an additional $284 billion in funding, referred to as PPP-2.

With so much of the workforce working remotely and the need to limit in-person contact, organizations dramatically increased the speed of adoption of digital technologies and converted manual, paper-based procedures to digital – from timecards, submitting receipts for reimbursement, and manual paycheck delivery, to taking customer orders. What’s more, many of these changes will be long lasting. According to a new McKinsey Global Survey, companies have accelerated the digitization of their customer and supply-chain interactions and of their internal operations by three to four years. In fact, technology’s strategic importance has become a critical component of business, not just a source of cost efficiencies.

This digitization investment will keep companies agile so they can respond to crises as well as evolve customer and employee demands. Cloud solutions offer key benefits that are critical for small businesses — like scalability, flexibility, cost, innovation, maintenance, and security.

PPP-2 funds can be used for both payroll and non-payroll expenses, including payroll costs, benefits, mortgage interest, rent, utilities, worker protection costs related to COVID-19, uninsured property damage costs caused by looting or vandalism in 2020, and certain supplier costs and expenses for operations, which includes payments for business software or cloud computing.

The following entities are eligible to apply for a First Draw PPP Loan through the latest wave of funding:

Second Draw PPP Loan Eligibility Requirements for Borrowers

Second Draw PPP Maximum Loan Amount

Second Draw PPP Full Forgiveness Terms

Second Draw PPP Loans made to eligible borrowers qualify for full loan forgiveness if during the 8- to 24-week covered period following loan disbursement:

To learn more, check out the Paylocity website.

Contact Claremont at 800.696.4543 or info@claremontcompanies.com for assistance when you’re ready to enroll a group in a Paylocity plan.

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

According to the recently released Ease 2021 SMB Benefits and Employee Insights Report that focuses on the last three years (2018-2020), business decision makers are coping with healthcare increases by seeking ways to balance meaningful access and quality care with affordability. The report also offers a glimpse into how COVID-19 impacted SMB benefits, as well as shifted the way employees interact with their benefits.

With data collected from 2,000 health insurance agencies, 75,000 small businesses, and 2.5 million employees nationwide that use Ease, the Report found a continuation of the rise of healthcare costs and a sustained need to offer competitive total rewards packages, all while seeking new and innovative ways to contain mounting costs.

The Report Features Insights and Trends On:

Medical premiums for families and individuals continue to steadily rise, with rate increases eclipsing the rate of inflation for 2020. The average company in Ease saw an increase in individual medical premiums of 5.98%, while family medical premiums increased an average of 3.74%. These increases pose unique challenges to businesses as they try to contain costs while offering quality healthcare.

In 2020, companies that use Ease contributed an average of 73.97% to their employees’ individual medical premiums (down from 74.24% in 2019) and 59.12% to family medical premiums (unchanged for the past three years). This suggests that while premium costs continued to rise, employers’ costs remained fixed, passing the increase onto their employees.

Over the last three years, employers have reduced the number of medical plans offered by about 3%. By controlling and shrinking the number of medical plans available to employees, companies are able to steer their employees to selecting more affordable plan options, such as High Deductible Health Plans (HDHPs).

Voluntary benefits help supplement the gaps found in core medical plans, and are a smart way for companies to attract talent. Typically, the larger the company, the more voluntary benefit plans offered per employee. On average, the number of voluntary benefit plans offered per employee has increased by approximately 3% since 2018. The most popular plans are dental, vision, life, AD&D, and short- and long-term disability.

Businesses with:

Throughout 2020, during the pandemic, the key to small business survival is anticipation and adaptation. Small businesses forced to do more with less are in greater need of the right tools and technology to supplement tasks and activities previously handled by employees.

With the rise in unemployment and market volatility in 2020 as a result of COVID-19, certain industries were hit harder than others. The five hardest hit industries from a job loss and revenue perspective were hotels, sports and performing arts, furniture and home furnishing stores, restaurants and bars, and motion picture and sound recording.

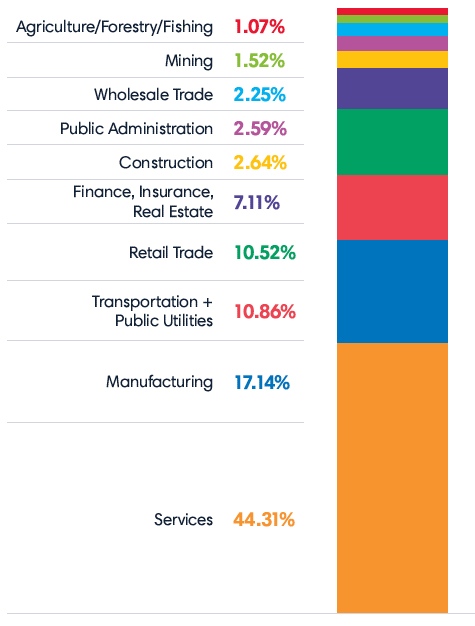

Of the 75,000 SMBs using Ease, the hardest hit industry was services (44.31%), followed by manufacturing (17.14%), and then transportation and public utilities (10.86%).

The largest category within the services segment is business services (47.87%), followed by health services (26.65%), and educational services (just under 10%).

In 2020, Brokers Helped Their Groups with The Following Activities:

Telemedicine rapidly became a necessity in 2020 and the number of employees enrolled increased 109% year-over-year.

Many of the 18 million furloughed workers returned to their companies in the second and third quarters.

To better understand the latest trends in healthcare and voluntary benefits, and advise your clients, download the Ease 2021 SMB Benefits and Employee Insights Report.

Ease is an online benefits enrollment system that makes it simple for insurance brokers and small business employers to set up and manage benefits, onboard new hires, stay compliant, and offer employees one destination for all their human resources information.

The Ease Marketplace is equipped with products, technology solutions, and resources to help you stay ahead of industry trends, defend against new competitors, and build a robust HR offering.

Don’t have an Ease account?

Contact us for free Ease online enrollment for your groups with one line of coverage or more.

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

Please join us in congratulating Laura Hogsed and Karlee Navarro on their recent promotions, each to the new position of Assistant Manager, Service Team. As Assistant Managers, Laura and Karlee will be instrumental in helping clients receive the best service possible. They will assist in resolving complex matters, will manage workflow, and will solicit feedback from clients to improve on or develop new services while helping fellow team members realize their professional growth goals.

With over 20 years’ experience in the healthcare industry (seven years with Claremont) and with extensive knowledge of pharmacy benefits, Laura brings a wealth of knowledge to her new role. She is one of the most well-rounded members of the service team; if Laura does not have the answer (and that is rare) she can find it quickly. Laura enjoys the respect of everyone she works with, from clients to partners to teammates. We congratulate Laura on her promotion!

Karlee is the newest member of our service team, joining Claremont in 2020, and she has quickly made her mark. Karlee brings extensive experience from the brokerage side of the business where she managed a service team and a book of business while assisting producers as they pursued new opportunities. Karlee has deep knowledge in group benefits, understands and appreciates the broker’s and account manager’s perspectives, and has that unique “calm in a crisis” attitude that allows her to successfully work through the most challenging issues. We congratulate Karlee on her promotion!

You can reach Laura at laura@claremontcompanies.com or 925.296.8823 and Karlee at karlee@claremontcompanies.com or 925.296.8816.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Please join us in congratulating Kim Dantono on her recent promotion to the most senior level Broker Service Representative at Claremont. Kim joined us five years ago with a focus on quoting. We are sure that many of you have worked with Kim to design proposals for your clients and prospects that have helped win new business for us all. She has an encyclopedic knowledge of small group products and the quoting services that support them.

Kim quickly began assisting in other areas of the service department, building knowledge and skills in sales support, application processing, enrollment support, broker support, and she’s our resident EASE guru too! We all know Kim as someone who will take on any challenge and find a way to deliver; always with a smile and wonderful attitude. Congratulations Kim!

You can reach Kim at kdantono@claremontcompanies.com or 925.296.8813.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.