To access the carrier product and rate information provided by PRISM, check the box below indicating you have read and agree to the license agreement. A button will then appear to access PRISM.

This site uses cookies to track your agreement option. If the terms of the license agreement change or if you clear the cookies from your browser, this page will appear once again during the PRISM login process.

New Cigna + Oscar (C+O) small group sales and renewals will not be offered in 2025. At C+O’s request, all plans and rates have been removed from the quote engine. However, you can still quote or renew your C+O groups through December 15, 2024 by contacting us at quotes@claremontcompanies.com or 800.696.4543. Please note: the last day of coverage will be December 14, 2025.

For assistance, please contact our Quotes team at quotes@claremontcompanies.com or 800.696.4543.

Login To PrismCigna + Oscar has announced two new plans for 2024, along with a new enhanced virtual primary care offering. Q1-2024 rates are now available through PRISM, our free and easy online quoting system. The Q1 statewide average rate increase across all metallic tiers is less than 1%.

New HSA plans

Two new HSA plans have been added to the Open Access Plus PPO and LocalPlus® PPO networks, effective January 1, 2024:

New Oscar (Virtual) Primary Care

Available in all non-HSA plans (pending regulatory approval) for new groups effective January 1, 2024 and for existing groups on their 2024 renewal. Oscar Primary Care offers enhanced virtual visits by video, phone, or secure messaging and:

To learn more, download these flyers:

With Cigna + Oscar, your groups get quality care and all of these (EPO) plan features:

With rates comparable to Kaiser, and networks that include Dignity Health, UCSF, Stanford, and Sutter, Cigna + Oscar brings together the power of Cigna’s nationwide and local provider networks, and Oscar’s member-focused tech-driven experience, to deliver small group health insurance that meets the unique needs of California small businesses and their employees. Learn more about Cigna + Oscar.

Note: to enroll your groups, you will need to have an appointment with Cigna + Oscar. Check out the Cigna + Oscar Appointments Guide for full instructions.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Covered California for Small Business (CCSB) has announced several new portal and administrative updates.

New Renewals

Starting with January 2024 renewals, CCSB has updated the format and included employee worksheets based on the current offerings. The renewals and Employee (EE) Worksheets can be found through the Employer Dashboard on MyCCSB.com under “Documents > Letters.” The Employer Proposal and the Employee Renewal Worksheets will be listed separately. The Employee worksheets are only available through the portal and will not be physically mailed with the Employer Renewal.

New Business Submission Deadlines

The workaround is no longer needed when submitting a new business case after the 25th of the month. You can now submit your new business cases through the portal for your intended effective date, through the end of the day on the 7th (includes weekends and holidays). The system will now require the Late Submission form when submitting past the initial deadline (2023 and 2024 deadlines). With this enhancement, employee applications/waivers will not be required with your submission if the employee enrollment is completed online.

SIC Requirement

The portal will now require the SIC when entering a new business case or completing a renewal when the SIC is missing.

Disabled ACH Feature and Reinstatement Policy

Effective immediately, CCSB will begin to enforce their policy on payments that have been returned unpaid and the number of times a policy can be reinstated after termination for non-payment.

Returned Payment Policy

The ability to enter one time or recurring ACH payments through MyCCSB.com will be restricted for 12 months (365 days) when two returned payments have occurred on the account within six months (183 calendar days).

Notices will be sent out based on the mode of delivery selected by the employer. For example: If the employer is opted into paperless delivery, they will only get an email notice with their agent cc’d if one is attached. If they are not opted into paperless delivery, notices will be physically mailed to the employer only. View the Partner Alert for details.

Policy Reinstatement After Termination for Non-Payment

A qualified employer terminated due to non-payment of premium may only reinstate once during the 12-month period beginning at the time of their original effective date or from their most recent renewal date, whichever is more recent. Exceptions will be considered on a case-by-case basis. View the Partner Alert for details.

With the CCSB bonus program, agents who place new small group business with CCSB from July 1, 2023 – January 1, 2024, can earn up to a $12,000 bonus per group, in addition to competitive commissions. To qualify for the first bonus tier of $1,000, agencies must submit a minimum of three groups with four enrolled employees. Best of all, the bonus is per group with no maximum number of groups! Download the flyer for details.

In addition to California’s most comprehensive access to doctors and hospitals, CCSB health plans offer choice and control, with:

As a trusted CCSB partner since its 2014 launch, we are a top-producing general agency in our sales territory. From agent certification and quoting to assessing new group eligibility and resolving post-enrollment issues, our CCSB experts will provide guidance and support every step of the way.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Patricia has decades of experience in healthcare and benefits administration. Her varied roles include provider, medical group and hospital contracting, multistate network development, national recruitment/contracting of mental health providers, and creating the state’s first network of complementary/alternative healthcare providers.

Her superior bilingual skills and firsthand knowledge of the cultural issues in the Hispanic community support her understanding of underserved community groups and the brokers who serve them.

As a member of the Claremont Insurance general agency family, she is focused on bringing education, advocacy and differentiation to the agent and broker community throughout California.

Patricia and her family enjoy the beautiful surroundings throughout the state. Big Sur and Mendocino coasts are among her favorite locations to explore with beach walks and hikes in the mountains and trails on her weekends. She also enjoys serving her local community by volunteering through local agencies and her community of faith.

You can reach Patricia at patricia@claremontcompanies.com or 925.296.8817.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

The 2024 Small Group Special Enrollment Period (SEP) starts November 15, 2023.

The Small Group SEP is the opportunity for employers to enroll in coverage with a $0 contribution requirement and no minimum participation requirement (at least 1 employee must enroll). The limited application period is from November 15 to December 15, 2023, for coverage effective January 1, 2024. Learn more.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

By law, all carriers are required to offer the small group Special Enrollment Period (SEP) one time per year to allow employers to enroll in coverage with a $0 contribution requirement and no minimum participation requirement. The application period is from November 15 to December 15, 2023, for coverage effective January 1, 2024. Carrier administration of the SEP may vary slightly, including recertification at renewal.

Please note: the Special Enrollment Period is different than the relaxed participation promotions. These carrier promotions are usually offered for a specific time period and may be discontinued at any time.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

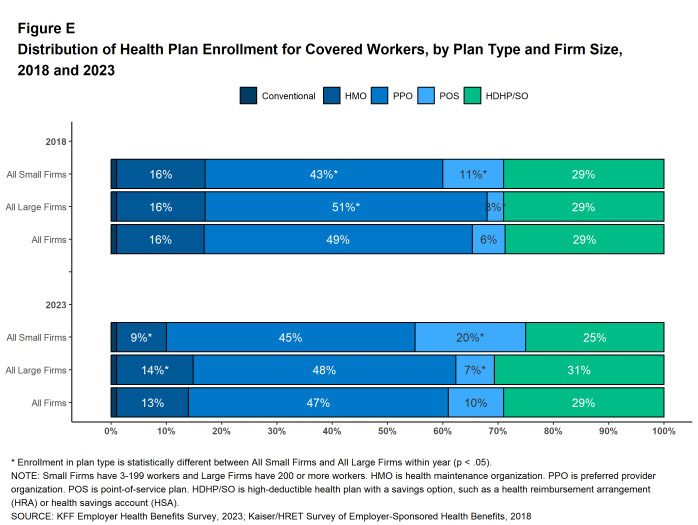

Average premiums for employer-sponsored health insurance jumped 7% for both individual and family plans this year — a significant increase after last year’s negligible growth. As disclosed in the 2023 Kaiser Family Foundation (KFF) survey, rising employer healthcare premiums have resumed, a reminder that while there has been great progress expanding coverage, people continue to struggle with medical bills.

The 25th annual KFF 2023 Employer Health Benefits Survey, conducted between January and July 2023, of 2,133 randomly selected private and non-federal public firms of three or more workers, provides a detailed look at trends in employer-sponsored health coverage, including premiums, employee contributions, cost-sharing provisions, offer rates, wellness programs, and employer practices. This year’s report also looks at abortion coverage, mental health and substance use services, and wellness programs.

Check out the KFF 2023 Employer Health Benefits Survey to stay updated on the latest employer-sponsored coverage trends and help employers recruit and retain workers with quality plans that employees value. Contact us today to develop tailored benefits solutions that address your clients’ needs.

KFF 2023 Employer Health Benefits Survey

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Claremont is excited to welcome Rebecca Hernandez as the newest member of the Service Team. Rebecca brings with her 6 years of industry experience. Most recently she held the position of Small Business Senior Renewal Specialist with eHealth Insurance, where she provided service in all 50 states, to over 9,000 groups. “Rebecca is the perfect addition to help round out our team,” says Laura Hogsed, Service Manager. “Her experience in renewal analyzation is a great asset which will take our ability to provide wholistic service to our brokers to a higher level.”

In her spare time, Rebecca enjoys taking Zumba classes, gem collecting or listening to self-improvement books.

You can reach Rebecca at rhernandez@claremontcompanies.com or 925.296.8822.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Blue Shield of California remains committed to providing your small group clients with comprehensive benefits that prioritize the well-being of employees. Here’s a summary of the changes for the first quarter of 2024.

Brokers can earn points for every new Tandem and Virtual Blue PPO membership.

The 10% specialty discount is a perpetual program that is applied when a dental and/or vision plan is added to a new or existing small business medical group.

The Relaxed Participation Promotion has been extended through December 31, 2024.

More information and plan summaries can be found in Blue Shield’s Q1-2024 Medical Sales Guide and Specialty Sales Guide.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

View the webinar on-demand to learn what’s new and changing for 2024, important health plan updates and reminders, the marketplace, and what you can expect from CaliforniaChoice. Below is a brief summary of what was covered in the webinar.

Eight health plans, 136 different plan designs (HMO, PPO, EPO and HSAs) and 20 different provider networks.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

In the ever-evolving landscape of employee benefits, the demand for disability insurance (DI) has surged 9% year-over-year, making it the fasted-growing benefit. In fact, 60% of employees now consider disability insurance a “must-have” benefit, second only to medical insurance.

Now more than ever, inclusive benefits packages are essential. It’s worth noting that employees from historically marginalized backgrounds, such as women, Black and Hispanic employees, and LGBTQIA+ community members, are more likely to consider DI indispensable. And employees with DI are 26% more likely to view their benefits package as inclusive.

Despite this increased demand, there remains a significant gap between interest and access. Currently, only 35% of employees have access to DI, down from 58% in 2019. What’s more, less than 3 in 5 employees are satisfied with their benefits that allow them to take time away from work, which hinders their ability to balance their professional and personal lives.

This “must-have” benefits gap directly impacts talent management. Employees with access to DI report greater benefits satisfaction, improved financial and mental health, and enhanced loyalty, compared to employees without access to DI.

In today’s competitive job market, a healthy work-life balance is critical and benefits that enable employees to take time away from work have never been more essential. Offering these benefits not only boosts recruitment, retention, engagement, and loyalty but also gives your clients a competitive advantage. Learn more.

Don’t miss this opportunity to offer valuable DI coverage and help your clients demonstrate their commitment to the well-being of their employees, thereby fostering a more loyal and productive workforce.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.