To access the carrier product and rate information provided by PRISM, check the box below indicating you have read and agree to the license agreement. A button will then appear to access PRISM.

This site uses cookies to track your agreement option. If the terms of the license agreement change or if you clear the cookies from your browser, this page will appear once again during the PRISM login process.

New Cigna + Oscar (C+O) small group sales and renewals will not be offered in 2025. At C+O’s request, all plans and rates have been removed from the quote engine. However, you can still quote or renew your C+O groups through December 15, 2024 by contacting us at quotes@claremontcompanies.com or 800.696.4543. Please note: the last day of coverage will be December 14, 2025.

For assistance, please contact our Quotes team at quotes@claremontcompanies.com or 800.696.4543.

Login To PrismIncrease your revenue with the Reliance Matrix 2023 SmartChoice Premier Producer Program and the 2023 Premier Producer Program.

Reminder: Reliances Matrix is the new name for Reliance Standard.

The SmartChoice portfolio of products features plan designs for groups with 2–19 lives.

All licensed producers (appointed with Reliance Matrix) that place new business or retain business are eligible to participate in the SmartChoice Premier Producer Program. The two-part, three-tier program allows you to earn more as you write more. Get the 2023 SmartChoice Premier Producer Program details.

Available for all lines of coverage outside of the SmartChoice portfolio, the Premier Producer Program offers customizable plan options for groups with 10+ enrolled.

All licensed producers (appointed with Reliance Matrix) who achieve both new sales and persistency goals are eligible to participate in the Premier Producer Program. Hit the agreed upon goals, and as a Premier Producer you’ll be rewarded with enhanced compensation on your book of business.

All employer-paid and voluntary group contracts count toward qualification and calculation for the Premier Producer Program. Lines of coverage:

Learn more about the 2023 Premier Producer Program.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

According to the recently released Ease 2023 SMB Benefits and Employee Insights Report, that focuses on the evolving benefits landscape for businesses with 1-250 employees, the smallest businesses are seeing the biggest medical premium increases. The report also offers insights into the benefits pressures employers and employees face and shares data to help you and your clients make informed decisions for the coming year.

With anonymized data collected from more than 2,300 health insurance agencies, 85,000 businesses, and 3.4 million+ employees nationwide that use Ease, the Report found medical premiums continue to climb, employees today expect their organizations to recognize their lives inside and outside of work, and employers and employees are asking more and more of each other.

A cooling job market, hints of a coming recession, unclear return-to-office plans, supply chain disruptions, and inflation, will continue to be challenging for small-to-medium businesses (SMBs).

Brokers who succeed will be the ones who stay out in front and offer benefits that matter to their clients – all while keeping an eye on the bottom line. To do this, they must rely on data-driven insights to learn from what’s come before and what could come next.

You’ll Find Features Insights and Trends On:

Medical premiums are experiencing cost increases much like everything else. Since 2018, individual premiums saw a 21% increase, while family premiums have a slightly lower increase at 17.87% over the same time period. That’s a $104 per month increase for individuals and a $231 per month increase for families — or $1,248 and $2,772 per year — significant for any household.

While the jump in average premiums from 2021 to 2022 fell under the 6.5% rate of inflation, the smallest employer groups were dealt the hardest blow. Employers with only 1-10 employees saw an increase of 12.07%. That’s nearly double the rate of inflation and the largest increase this segment has experienced in the past four years.

Continuing the trend seen since 2018, the smaller the company the more their employees paid toward benefits. Employees working for companies with 101-250 employees paid 37% less than those working for companies with 1-10 employees this past year.

When it comes to plan-type adoption, HMOs and PPOs remain the most popular choice for employees, more than 50% of SMB employees opted to waive coverage entirely, up 13% from 2020.

Though the uptake of consumer-driven health plans remains a small slice of the pie, participation in High Deductible Health Plans (HDHPs) has increased 68% year-over-year. Panning out, HDHPs typically combine with a Health Savings Account (HSA). Given the current state of the economy, households may be opting to use higher deductible plans to save money on their monthly premiums in spite of the higher financial risk if a major medical event occurs. More money in their pockets each month seems like a safer bet.

On average, businesses with more employees offered more medical plans than those with fewer employees in 2022.

Non-medical voluntary benefits offer SMBs a unique way to meet the needs of their employees without destroying their budgets. Must-haves like dental, vision, and life top the list for SMB employees, but lifestyle benefits like financial wellness, legal services, and pet insurance continue to gain steam.

Vision coverage continues to see a decrease year-over-year in premium cost. Short-term disability saw the biggest jump from 2020 to 2022 at almost 12% ($2.75 per month, or $33 more annually).

Similar to the trend seen with medical plans, the larger the company, the more voluntary benefits plans offered per employee in 2022.

Groups in Ease experienced a nominal increase in the average number of employees. While all segments have seen a small uptick in employees from 2021 to 2022, all fluctuations are within one point when looking at a three-year trend line. Outside of Ease, SMBs experienced a net job loss of 3 million,* or a shrinking of 5% of the total workforce.

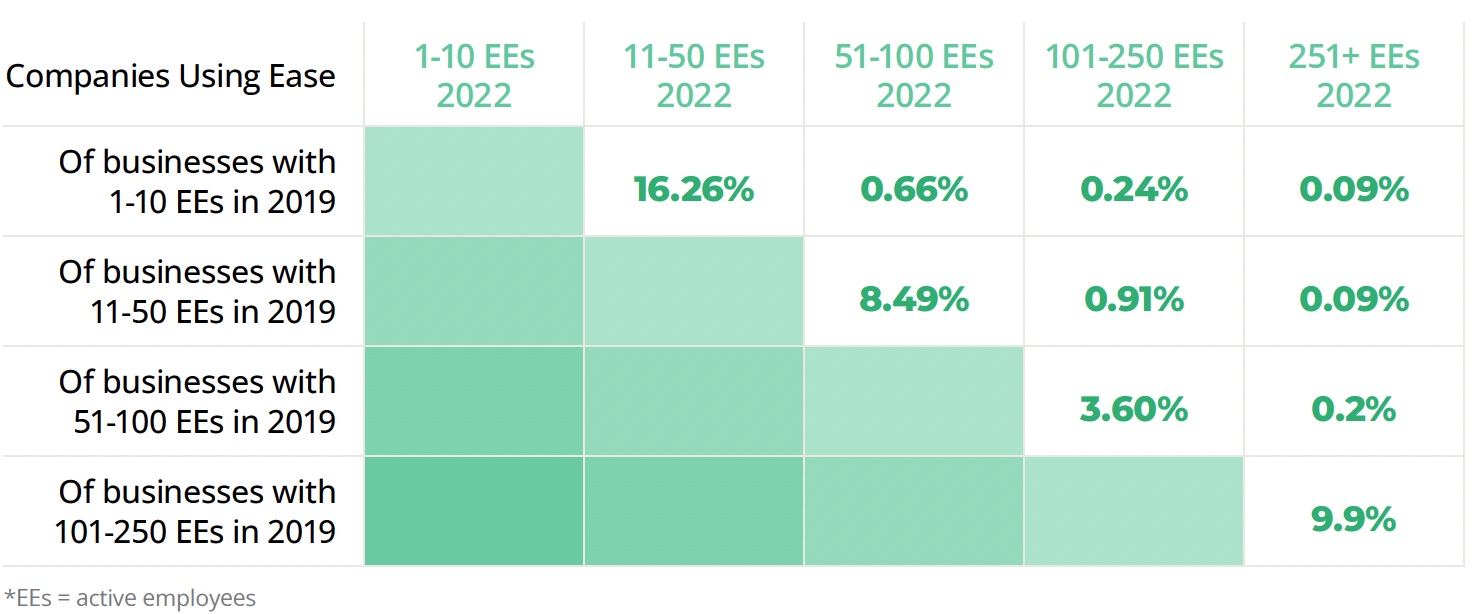

Ease looked at companies using their system since 2019. Overall, 13.29% of companies using Ease grew, while 7.68% shrank over the same period.

By using the data from Ease’s survey of 1,000 U.S.-based employers and employees, you’ll be able provide options and ongoing management support year-round to recession-proof your business.

Employers (ERs) and Employees (EEs) top benefits priorities in 2023:

Employer expectations for year-round support continue to increase. In fact, only 6% of employers surveyed think their broker is needed only during open enrollment. That means 94% expect consultation, innovation, and ongoing management support year-round.

37.52% of agencies offered more support to clients this year than last year by helping them onboard new hires online, conducting benefits elections remotely, and providing compliance support.

78% of agencies anticipate their groups wanting more insurance options this upcoming enrollment season:

73.77% of employers believe benefits administration technology is a higher or equal priority going into this year’s open enrollment.

For a deeper understanding of the latest employee benefits trends and to better advise your clients, download the Ease 2023 SMB Benefits and Employee Insights Report.

Ease is an online benefits enrollment system that makes it simple for insurance brokers and small business employers to set up and manage benefits, onboard new hires, stay compliant, and offer employees one destination for all their human resources information.

The Ease Marketplace is equipped with products, technology solutions, and resources to help you stay ahead of industry trends, defend against new competitors, and build a robust HR offering.

Don’t have an Ease account?

Contact us for free Ease online enrollment for your groups with one line of coverage or more.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

*U.S. Small Business Administration Office of Advocacy, 2022 Small Business Profile Infographic

BRI is offering a new Health Account Outlook Series which will run from February 2023 through April 2023. Through this series they will tackle a variety of topics affecting health accounts including generational and behavior trends, consumer attitudes, how legislation and rules impact your strategy, and some of the hidden challenges (and opportunities) of health accounts.

The Session Will Cover:

Webinar Details

All registered attendees will receive a recording following the live event. Register now!

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Social selling is about finding, engaging, and connecting with your target audience through social media. It can help you better qualify prospects, expand your reach and raise awareness, promote your company, engage with prospects and clients, conduct research, gain trust, and establish relationships to increase sales.

With over 830 million members, LinkedIn is the only platform focused on business and professional networking and it’s an essential tool for brokers looking to connect with potential clients. In fact, it’s one of the top places to reach decision makers, influencers, and practitioners.

According to Hubspot, B2B blogs and websites receive most of their social media traffic from LinkedIn. And 43% attributed their sales to LinkedIn, Facebook followed at 24%, and Twitter at 20%.

There is no ‘silver bullet’ for attracting LinkedIn leads. Instead you’ll need a combination of strategies to establish yourself on the platform and get in front of your target audience. To help, here’s our first Social Selling Tips article on how to turn your profile into a business growth machine.

An Optimized Professional LinkedIn Profile:

Your profile should be a landing page that focuses on the needs of your prospects and clients. Make sure to include all of your contact details and keep it up to date. It does influence sales!

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Oral health is more important than you might think. The health of your mouth, teeth, and gums can have a significant impact on your general health. In fact, gum disease and tooth decay are associated with several systemic conditions. That’s why Delta Dental’s SmileWay® Wellness Benefits program provides additional teeth and gum cleanings throughout the year for enrollees with certain chronic medical conditions.

According to the Centers for Disease Control and Prevention, chronic health conditions and unhealthy behaviors reduce worker productivity and cost US employers $36.4 billion a year because of employees missing days of work.

A healthier workforce can result in lower direct costs, such as insurance premiums and workers’ compensation claims, and lower indirect costs if workers miss less work due to illness. With SmileWay Wellness Benefits, members stay healthy and more productive.

Delta Dental PPO™ members and their dependents can take advantage of enhanced benefits and receive up to five cleanings per calendar or contract year if they’ve been diagnosed with one of the following chronic medical conditions:

When employees keep up with regular cleanings, they can reduce the symptoms and complications of their chronic conditions, and help prevent further health issues.

More Covered Cleanings Every Year

Once enrolled in SmileWay Wellness Benefits, Delta Dental PPO members with qualifying chronic conditions are eligible for extra routine and periodontal cleanings:

How to Enroll

For groups with this benefit, enrollees who have been diagnosed with any of the qualifying chronic conditions will need to opt in online or call Customer Service to access the expanded coverage.

Delta Dental’s SmileWay Wellness Benefits can be added to all mid-size and large group Delta Dental PPO plans. Download the SmileWay Wellness Benefits broker flyer and SmileWay Wellness Benefits member flyer to learn more.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Reliance Standard Life Insurance Company has rebranded to Reliance Matrix. The new name combines Reliance Standard and its sister company Matrix Absence Management into one unified brand that provides financial protection and supplemental health plans for employees, while helping employers maximize productivity by managing time away from work. Get the details.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Ease, an online benefits enrollment system, makes it simple for insurance brokers and small business employers to set up and manage benefits, onboard new hires, stay compliant, and offer employees one destination for all their human resources information.

What’s more, the Ease Marketplace is equipped with products, technology solutions, and resources to help you stay ahead of industry trends, defend against new competitors, and build a robust HR offering.

Why Over 2,300 Agencies Trust Ease to Grow Their Business

Save Your Clients Time and Increase Employee Engagement

Download the Ease flyer to learn more.

Don’t have an Ease account?

Contact us for free Ease online enrollment for your groups with one line of coverage or more.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

COBRA is a complex set of laws and regulations with many traps for the unwary, and mistakes can be costly. BASIC’s COBRA expert, Tammy Parr, will outline COBRA and its rigorous requirements.

You’ll Learn:

The 60-minute webinar will be followed by a Q&A and information about BASIC’s COBRA Administration.

BASIC’s webinar is approved for 1.0 SHRM-CP credits for advanced professional credentials for HR professionals worldwide. Credits are for live attendance only. Register now.

Presenter: Tammy Par

Tammy Parr is an Independent Sales Director at BASIC. With over 35 years of experience working with COBRA, Tammy leverages her expertise to ensure clients and insurance brokers are fully compliant every step of the way. Clients appreciate Tammy’s extensive regulatory knowledge, which allows her to recognize and satisfy personalized needs for companies of all sizes and industries. Insurance brokers love working with Tammy because they know she wants the best for their clients.

To learn more, check out the BASIC website and contact us at 800.696.4543 or info@claremontcompanies.com for assistance when you’re ready to enroll a group in a BASIC plan.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Please join us in celebrating the 30th work anniversary of Claremont President Michael Traynor.

Michael joined Claremont in 1993 as one of our founding employees and has since guided the company – and helped our customers grow and thrive – through many rounds of industry change during the last 30 years.

From company Chairman Bob Traynor: “I founded Claremont back in the early 1990s to help brokers build their health benefits businesses. Michael was one of our first employees, and I might be biased, but he turned out to be one of the best hires we made. Thank you Michael for carrying on the good work!”

From industry veteran Michael Lujan: “I think I speak for the whole industry when I say thank you Michael for your long-term and consistent support of California’s independent brokers and agents. Congratulations Michael on thirty years at Claremont!”

Please join us in wishing Michael a happy 30th work anniversary!

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Effective January 2023, Blue Shield of California is launching two new Virtual Blue plans, available in both the Small Group and Large Group portfolios.

The new Virtual Blue plans give members the choice of virtual or in-person care. Virtual care includes $0 unlimited visits to primary care, behavioral health and specialty care through a new partnership with AccoladeCare. In-person care is available through the Tandem PPO network in California and via BlueCard when outside of the state.

Employer Advantages Include:

Employee Advantages Include:

Learn more about Virtual Blue, including product resources, video explainers and plan summaries.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.