To access the carrier product and rate information provided by PRISM, check the box below indicating you have read and agree to the license agreement. A button will then appear to access PRISM.

This site uses cookies to track your agreement option. If the terms of the license agreement change or if you clear the cookies from your browser, this page will appear once again during the PRISM login process.

New Cigna + Oscar (C+O) small group sales and renewals will not be offered in 2025. At C+O’s request, all plans and rates have been removed from the quote engine. However, you can still quote or renew your C+O groups through December 15, 2024 by contacting us at quotes@claremontcompanies.com or 800.696.4543. Please note: the last day of coverage will be December 14, 2025.

For assistance, please contact our Quotes team at quotes@claremontcompanies.com or 800.696.4543.

Login To PrismEffective July 1, Blue Shield’s full Access+ HMO provider network is available in Platinum, Gold, and Silver metal tier plans in Covered California for Small Business (CCSB). Previously, these plans had been available only through the Trio HMO network.

Blue Shield Full Network Access+ Plans:

Plus, all Access+ plans include the richer Rx Ultra pharmacy network.

With this network upgrade, your small business clients across California can offer their employees even more healthcare provider options, providing them with greater flexibility and choice.

In addition to the full Access+ network, effective July 1, 2023, CCSB is introducing three new popular Blue Shield plans to its portfolio:

All Blue Shield plans through CCSB provide members access to Wellvolution (including Headspace and Ginger), Teladoc Mental Health, Nurse Help 24/7, LifeReferrals 24/7, and the Blue Card program for when members are outside of California.

With the new CCSB bonus program, agents who place new small group business with CCSB from July 1, 2023 – January 1, 2024, can earn up to a $12,000 bonus per group, in addition to competitive commissions. To qualify for the first bonus tier of $1,000, agencies must submit a minimum of three groups with four enrolled employees. Best of all, the bonus is per group with no maximum number of groups! Download the flyer for details.

In addition to California’s most comprehensive access to doctors and hospitals, CCSB health plans offer choice and control, with:

As a trusted CCSB partner since its 2014 launch, we are a top-producing general agency in our sales territory. From agent certification and quoting to assessing new group eligibility and resolving post-enrollment issues, our CCSB experts will provide guidance and support every step of the way.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Delta Dental is offering BrushSmart to its PPO™ and DeltaCare® USA members, providing significant discounts on dental products from major brands to encourage better at-home oral care habits.

BrushSmart Member Benefits Include:

The program aims to enhance at-home oral care and complement routine dental check-ups. All Delta Dental PPO™ and DeltaCare® USA members across all lines of business are eligible to enroll in BrushSmart. Members simply sign up for BrushSmart to have discounts sent directly to their inbox. Get the details.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Attend the MetLife webinar on Wednesday, May 17th at 10:00 am PT, with Vincent Branchesi, MetLife workforce expert and a leading voice of MetLife’s 21st Annual U.S. Employee Benefit Trends study, as he shares their latest research and recommendations.

You’ll learn:

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

With the newly added Blue Shield plans, Covered California for Small Business (CCSB) provides even more options for enrollees.

All Blue Shield plans through CCSB provide members access to Wellvolution (including Headspace and Ginger), Teladoc Mental Health, Nurse Help 24/7, LifeReferrals 24/7, and the Blue Card program for when members are outside of California.

With the new CCSB ‘A Partnership That Pays’ bonus, agents who place new small group business with CCSB from July 1, 2023 – January 1, 2024, can earn up to a $12,000 bonus per group, in addition to competitive commissions. To qualify for the first bonus tier of $1,000, agencies must submit a minimum of three groups with four enrolled employees. Best of all, the bonus is per group with no maximum number of groups! Download the flyer for details.

In addition to California’s most comprehensive access to doctors and hospitals, CCSB health plans offer choice and control, with:

As a trusted CCSB partner since its 2014 launch, we are a top-producing general agency in our sales territory. From agent certification and quoting to assessing new group eligibility and resolving post-enrollment issues, our CCSB experts will provide guidance and support every step of the way.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Check out these articles to learn more about the unwinding of Medi-Cal continuous coverage:

For many of the millions of Californians expected to lose Medi-Cal coverage, enrolling in their company health plan may be the best or only option for affordable coverage.

Your employer clients and prospects look to you for guidance and support in maintaining a healthy and productive workforce. This is a singular opportunity to deepen your client relationships, acquire more customers, and grow your business.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Help employers provide extra protection and financial security for their workforce in the event of a serious illness or injury by offering Beam’s new critical illness coverage.

The coverage includes a range of benefits, such as hospital stays, surgery, chemotherapy, and radiation treatments. Plus, it also offers financial assistance for expenses related to caregiving, travel, and other non-medical expenses.

A great option to supplement traditional health insurance, Beam’s critical illness coverage can be especially helpful for those with high-deductible health plans (HDHP).

A valuable addition to standard health insurance, Beam’s critical illness coverage can provide employees peace of mind and financial assistance during challenging times. Download the flyer for details.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Article last updated: April 27, 2023.

Most of your clients likely have upcoming deadlines under federal prescription drug benefits reporting requirements. Here’s a summary of the requirements, how carriers can help, and the deadlines.

Under Section 204 of the 2021 Consolidated Appropriations Act (CAA), insurance companies and employer-based health plans must submit information regarding prescription drug benefits and health care spending. The information must be submitted to the Centers for Medicare and Medicaid Services (CMS) by June 1st of each year for the prior year’s coverage.

Enforcement of the requirements was relaxed for reports due in 2021 and 2022. The requirements for reports due in 2023 are being enforced. Failure to report can lead to a penalty of $100 per day per affected individual.

A detailed summary on the requirements can be found in this helpful Mercer article (many carrier communications that you and your clients are receiving refer to technical terms such as “P2,” “D2-D8,” etc. This article explains these terms).

Each carrier is taking action to support your employer clients with the federal reporting requirements. In order to do so, they require information from each employer group. The approach being taken by each carrier is similar, but varies in detail, including important deadlines. Here’s a summary:

Aetna

Plan sponsors should fill out this RxDC Plan Sponsor Data Collection form with the required data by April 1, 2023. The required data includes the:

Anthem

Anthem is sending emails to Small Group and Large Group fully insured clients and Anthem Balanced Funding clients, asking them to submit monthly average premium information required for Prescription Drug Data (RxDC) reporting. Anthem clients should complete this form before March 24, 2023.

Blue Shield of California

Blue Shield is providing fully-insured groups and self-funded ASO group plan clients an option for collecting and reporting all the required information on their behalf. Groups electing this option must complete a Blue Shield Intake Form. Blue Shield has provided an Intake Form FAQ.

Blue Shield will submit the data report on behalf of fully-insured and self-funded ASO group plans only if the group provides a complete response to the questions on the intake form by March 31, 2023 by 6:00 pm PST. By completing the form, the employer consents that Blue Shield will submit the data on their behalf to the CMS.

If the employer group does not complete the intake form by March 17, 2023, then the employer group will be responsible for submitting all required data directly to the CMS by June 1, 2023.

More details can be found in emails sent recently by Blue Shield directly to brokers and employer groups.

CaliforniaChoice

The information above from CaliforniaChoice was provided verbally. Until this information is formally posted on the CaliforniaChoice website and especially for employers with Kaiser and Sutter enrollment, who are being advised that no action is required, Claremont strongly recommends that brokers contact the carrier and get formal confirmation as to what reporting assistance the carrier will or will not provide. In all cases, it is strongly recommended that the broker or employer request a receipt that the necessary reporting was indeed filed by the carrier. Keep that receipt in the event of a CMS audit.

Cigna+Oscar

Cigna intends to file on behalf of plan sponsors. No action is required of brokers or employers at this time. Look out for future communications from Cigna and Cigna + Oscar.

Covered California for Small Business

Covered California for Small Business (CCSB) is an administrator of its participating health plans and is not subject to RxDC data collection requirements on behalf of employer groups. CCSB has provided the following information for each of their participating health plans:

More details can be found in this April 11, 2023 CCSB broker email.

Kaiser Permanente

Kaiser Permanente (KP) needs to collect certain data in order to submit all applicable reports and required responses on behalf of employers. Employers with KP coverage in 2022 should complete this form no later than April 3, 2023. The broker can also complete the form on behalf of the employer. Once KP has the necessary data, it will submit all applicable reports and required responses to the CMS by the June 1, 2023 deadline.

Note: Kaiser asks for the data in a different way than other carriers. To help simplify the process, Claremont has created a worksheet (Excel, PDF) with instructions. If the broker or employer can assemble three pieces of data for each month in 2022, they can enter those into the worksheet and it will calculate the answers for Questions 8 and 9 which can then be entered into the Kaiser form.

Sharp Health Plan

Sharp Health Plan will be contacting their employer groups directly to obtain the required information. In addition, they will be sending a broker and employer alert informing all brokers and employers of the RxDC reporting requirement.

UnitedHealthcare

UnitedHealthcare (UHC) will assist clients by submitting all required information to the CMS if the employer completes UHC’s Pharmacy and Benefits and Costs Survey by March 10, 2023.

UHC sent an email communication on February 3, 2023 to all brokers/groups with fully-insured and Level-Funded plans instructing them of the data collection and action required to complete the Survey. Here is a link to the FAQs from UHC. It also links to the survey. Once the survey is complete, UHC will submit the necessary data to the CMS on behalf of the employer prior to the June 1, 2023 deadline.

The carriers are taking action to support your clients with the federal reporting requirements. In order to do so, they require information from each employer group. Look out for emails directly from the carriers, and follow their instructions. If you or your clients have questions, we can help direct you to the right contacts at the carriers.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

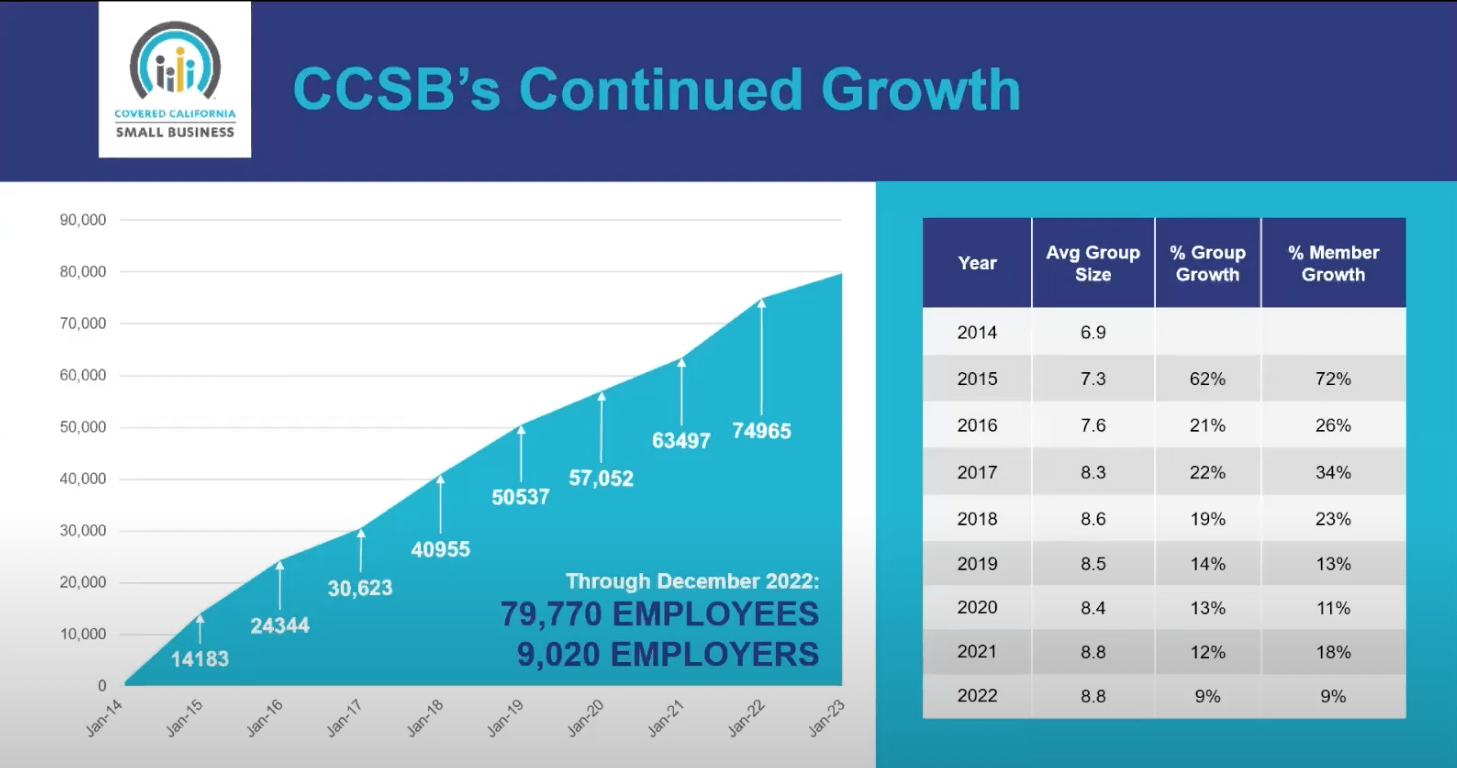

With over 9,020 employers and 79,770 employees enrolled as of December 2022, Covered California for Small Business (CCSB) continues to be a popular health insurance choice for small businesses. In fact, membership has grown significantly over the last few years:

CCSB is introducing the following new Blue Shield plans for Q3-2023 (effective July 1, 2023):

All Blue Shield plans through CCSB provide access to Wellvolution, Teladoc Mental Health, Nurse Help 24/7, LifeReferrals 24/7, and the Blue Card program for members outside of California.

With the new CCSB ‘A Partnership That Pays’ bonus, agents who place new small group business with CCSB from July 1, 2023 – January 1, 2024, can earn up to a $12,000 bonus per group, in addition to competitive commissions. To qualify for the first bonus tier of $1,000, agencies must submit a minimum of three groups with four enrolled employees. Best of all, the bonus is per group with no maximum number of groups! Download the flyer for details.

View the March 28th broker webinar and download the Q&As to learn about CCSB’s growth, advantages for brokers and employers, and the latest carrier offerings.

In addition to California’s most comprehensive access to doctors and hospitals, CCSB health plans offer choice and control, with:

As a trusted CCSB partner since its 2014 launch, we are a top-producing general agency in our sales territory. From agent certification and quoting to assessing new group eligibility and resolving post-enrollment issues, our CCSB experts will provide guidance and support every step of the way.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

With Blue Shield’s Small Business Incentive Program, earning points for qualified sales has never been easier (February 1, 2023 to January 1, 2024 effective dates). You can redeem your points for rewards from hundreds of great options, such as gift cards, electronics, products for your home, and more. Or convert your points to cash with a Visa gift card. Best of all, there are no complicated tiers or calculations required!

With the Producer Rewards points-based bonus program, each point is equal to one dollar. Plus it’s easy to keep track of your point status and what you’ve earned.

Learn more about the Small Business Incentive Program and Producer Rewards Program. Enroll in the Blue Shield Producer Rewards Program today.

Groups written through Claremont are eligible for this program.

As an additional incentive, earn points redeemable for rewards for renewing groups with new members into Blue Shield’s Tandem PPO, Virtual Blue, or specialty plans. What’s more, all point distributions are in addition to standard commissions.

Download the Renewal Rewards Program flyer to learn more.

Groups written through Claremont are eligible for this program.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Help give your clients financial protection and peace of mind with Beam’s two-year rate guarantee on new dental and vision quotes. This promotion is available to groups with 10-499 eligible employees who quote with Beam now through June 30, 2023, with an effective date between April 1, 2023 and September 1, 2023. To learn more, visit Beam and download the flyer.

Beam dental and vision plans are available for 2+ enrolled employees.

Standard Plan Features

Dental Provider Networks

Vision: VSP® Vision Care Plans & VSP® Choice Network

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.