To access the carrier product and rate information provided by PRISM, check the box below indicating you have read and agree to the license agreement. A button will then appear to access PRISM.

This site uses cookies to track your agreement option. If the terms of the license agreement change or if you clear the cookies from your browser, this page will appear once again during the PRISM login process.

New Cigna + Oscar (C+O) small group sales and renewals will not be offered in 2025. At C+O’s request, all plans and rates have been removed from the quote engine. However, you can still quote or renew your C+O groups through December 15, 2024 by contacting us at quotes@claremontcompanies.com or 800.696.4543. Please note: the last day of coverage will be December 14, 2025.

For assistance, please contact our Quotes team at quotes@claremontcompanies.com or 800.696.4543.

Login To PrismWith an effortless transition process for your Cigna + Oscar (C+O) groups, Covered California for Small Business (CCSB) simplifies enrollment by using the group’s prior C+O invoice.

CCSB provides a variety of health plans tailored to the unique needs of small businesses. By partnering with industry-leading insurance carriers, they guarantee your clients access to high-quality, affordable health coverage options.

Maximize your earnings with CCSB’s broker bonus program. For new small group business placed from July 1, 2024 to January 1, 2025, you can earn up to a $12,000 bonus per group, in addition to competitive commissions. Download the flyer for details.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

With the Covered California for Small Busines (CCSB) bonus program, agents who place new small group business from July 1, 2024 – January 1, 2025, can earn up to a $12,000 bonus per group, in addition to competitive commissions. To qualify for the first bonus tier of $1,000, agencies must submit a minimum of three groups with four enrolled employees. Best of all, the bonus is per group with no maximum number of groups! Download the flyer for details.

In addition to California’s most comprehensive access to doctors and hospitals, CCSB health plans offer choice and control, with:

As a trusted CCSB partner since its 2014 launch, we are a top-producing general agency in our sales territory. From agent certification and quoting to assessing new group eligibility and resolving post-enrollment issues, our CCSB experts will provide guidance and support every step of the way.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Article last updated: March 19, 2024.

Most of your clients likely have upcoming deadlines under the federal prescription drug benefits reporting (RxDC) requirements. Here’s a summary of the requirements, how carriers are helping, and the deadlines.

Under Section 204 of the 2021 Consolidated Appropriations Act (CAA), insurance companies and employer-based health plans must submit information regarding prescription drug benefits and health care spending. The information must be submitted to the Centers for Medicare and Medicaid Services (CMS) by June 1st of each year for the prior year’s coverage.

According to the CMS, the information that is required to be submitted by insurance companies and employers are:

Blue Shield will collect D1 Premium information from groups between February 5, 2024 and April 19, 2024. Blue Shield will also submit D2 for all groups and D3-D8 for groups with prescription drug benefits under a Blue Shield health benefit plan, and P2 accordingly. If a group does not have prescription drug benefits with Blue Shield, they should coordinate submission of D3-D8 with their pharmacy/prescription drug benefits carrier, and P2 accordingly.

Key Details

Other Details:

Information Requested

Due to technical issues on their end and updated guidance from CMS about the 2024 submission, below are revised dates:

UnitedHealthcare will complete the CAA Prescription Drug (RxDC) reporting for its fully insured and self-funded/level funded groups, including those with OptumRx as the integrated PBM. However, groups with these will need to complete the Request for Information (RFI) tool for RxDC reporting between February 1, 2024, and March 31, 2024. The March 31, 2024, deadline is firm.

To support its customers with this important filing, UnitedHealthcare will be submitting the P2 (Group Health Plan), D1 (Premium and Life Years) and D2 (Spending by Category) files for all employers who had active coverage during the reference year (2023). However, completion of the submission requires gathering some information not currently maintained in their system.

UnitedHealthcare will also submit the D3-D8 data files for customers with OptumRx as an integrated PBM. UnitedHealthcare has access to all data required to complete the submission of the D3-D8 data files. Customers who use any other PBM, including OptumRx Direct, must work with that PBM to submit the D3-D8 files.

Resources

Kaiser Permanente is required to submit information on prescription drugs and healthcare spending to CMS. On February 1, 2024 Kaiser Permanente began to send out a survey form from Kaiser-Permanente-RxDC@kp.org to all contract signers to request this information. The form must be completed by March 15, 2024.

Information Requested

Kaiser Permanente plans to submit all applicable reports and required responses for all employer groups to CMS by the June 1, 2024 deadline.

Employer groups must submit information to Sutter Health Plus regarding the average monthly premiums paid on behalf of enrollees and the amount paid by enrollees each year.

For calendar year 2023 reporting, employers or brokers are to submit the required information through the online Premium Reporting Form.

Submissions are due no later than March 1, 2024.

Cigna is reporting on behalf of Cigna + Oscar groups, so no action is required by employer groups or brokers.

Covered California for Small Business (CCSB) serves as an administrator of their participating Health Plan Issuers and is not an insurance company nor an employer-based health plan. Therefore, CCSB is not subject to RxDC data collection requirements on behalf of their employer groups. Claremont recommends that the employer follow the reporting guidelines for the enrolled carrier(s).

CCSB Resources – CCSB’s Small Business Service Center is available to help with questions at 855.777.6782.

CaliforniaChoice serves as an administrator of their participating Health Plan Issuers and is not an insurance company nor an employer-based health plan. Therefore, CaliforniaChoice is not subject to RxDC data collection requirements on behalf of their employer groups. Claremont recommends that the employer follow the reporting guidelines for the enrolled carrier(s).

The carriers are taking action to support your clients with the federal reporting requirements. In order to do so, they require information from each employer group. Look out for emails directly from the carriers, and follow their instructions. If you or your clients have questions, we can help direct you to the right contacts at the carriers.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Covered California for Small Business (CCSB) has announced several new portal and administrative updates.

New Renewals

Starting with January 2024 renewals, CCSB has updated the format and included employee worksheets based on the current offerings. The renewals and Employee (EE) Worksheets can be found through the Employer Dashboard on MyCCSB.com under “Documents > Letters.” The Employer Proposal and the Employee Renewal Worksheets will be listed separately. The Employee worksheets are only available through the portal and will not be physically mailed with the Employer Renewal.

New Business Submission Deadlines

The workaround is no longer needed when submitting a new business case after the 25th of the month. You can now submit your new business cases through the portal for your intended effective date, through the end of the day on the 7th (includes weekends and holidays). The system will now require the Late Submission form when submitting past the initial deadline (2023 and 2024 deadlines). With this enhancement, employee applications/waivers will not be required with your submission if the employee enrollment is completed online.

SIC Requirement

The portal will now require the SIC when entering a new business case or completing a renewal when the SIC is missing.

Disabled ACH Feature and Reinstatement Policy

Effective immediately, CCSB will begin to enforce their policy on payments that have been returned unpaid and the number of times a policy can be reinstated after termination for non-payment.

Returned Payment Policy

The ability to enter one time or recurring ACH payments through MyCCSB.com will be restricted for 12 months (365 days) when two returned payments have occurred on the account within six months (183 calendar days).

Notices will be sent out based on the mode of delivery selected by the employer. For example: If the employer is opted into paperless delivery, they will only get an email notice with their agent cc’d if one is attached. If they are not opted into paperless delivery, notices will be physically mailed to the employer only. View the Partner Alert for details.

Policy Reinstatement After Termination for Non-Payment

A qualified employer terminated due to non-payment of premium may only reinstate once during the 12-month period beginning at the time of their original effective date or from their most recent renewal date, whichever is more recent. Exceptions will be considered on a case-by-case basis. View the Partner Alert for details.

With the CCSB bonus program, agents who place new small group business with CCSB from July 1, 2023 – January 1, 2024, can earn up to a $12,000 bonus per group, in addition to competitive commissions. To qualify for the first bonus tier of $1,000, agencies must submit a minimum of three groups with four enrolled employees. Best of all, the bonus is per group with no maximum number of groups! Download the flyer for details.

In addition to California’s most comprehensive access to doctors and hospitals, CCSB health plans offer choice and control, with:

As a trusted CCSB partner since its 2014 launch, we are a top-producing general agency in our sales territory. From agent certification and quoting to assessing new group eligibility and resolving post-enrollment issues, our CCSB experts will provide guidance and support every step of the way.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Earn a Kaiser Permanente $100 bonus, per enrolled member when you enroll at least 10 members from a qualified, new small group through CaliforniaChoice, Covered California or Kaiser Small Business. October 1, 2023 – January 31, 2024 effective dates.

Earn a $2,100 bonus when you sell a new group with 30 full-time employees and enroll 21 new members with Kaiser Permanente.

21 enrolled members x $100 = $2,100.

This bonus is on top of your regular commission and standard broker reward programs such as the Total Replacement and Group Production rewards. Download the flyer for details.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Covered California for Small Business (CCSB) is pleased to introduce several new Blue Shield of CA plans that are now available for quoting. Carefully designed to meet the diverse needs of your valued employers, these plans are available for both new business enrollments and existing business renewals effective July 1, 2023.

With these upgrades, your small business clients across California can offer their employees even more healthcare options, providing them with greater flexibility and choice. To learn more, download the flyer.

All Blue Shield plans through CCSB provide members access to Wellvolution (including Headspace and Ginger), Teladoc Mental Health, Nurse Help 24/7, LifeReferrals 24/7, and the Blue Card program for when members are outside of California.

With the CCSB bonus program, agents who place new small group business with CCSB from July 1, 2023 – January 1, 2024, can earn up to a $12,000 bonus per group, in addition to competitive commissions. To qualify for the first bonus tier of $1,000, agencies must submit a minimum of three groups with four enrolled employees. Best of all, the bonus is per group with no maximum number of groups! Download the flyer for details.

In addition to California’s most comprehensive access to doctors and hospitals, CCSB health plans offer choice and control, with:

As a trusted CCSB partner since its 2014 launch, we are a top-producing general agency in our sales territory. From agent certification and quoting to assessing new group eligibility and resolving post-enrollment issues, our CCSB experts will provide guidance and support every step of the way.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Effective July 1, 2023, Covered California for Small Business (CCSB) is adding two of Blue Shield’s most popular high deductible health plans (HDHPs) to its portfolio:

Both plans feature the Full PPO network. The deductible and out-of-pocket maximum are the same in both plans. And, there are no additional costs to the member after the deductible is met.

The recently announced large increases in HSA contribution limits for 2024 are likely to generate even more interest in HDHPs and HSAs. Now is a good time to discuss these new plan options with your clients and prospects.

In addition to California’s most comprehensive access to doctors and hospitals, CCSB health plans offer choice and control, with:

As a trusted CCSB partner since its 2014 launch, we are a top-producing general agency in our sales territory. From agent certification and quoting to assessing new group eligibility and resolving post-enrollment issues, our CCSB experts will provide guidance and support every step of the way.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Effective July 1, Blue Shield’s full Access+ HMO provider network is available in Platinum, Gold, and Silver metal tier plans in Covered California for Small Business (CCSB). Previously, these plans had been available only through the Trio HMO network.

Blue Shield Full Network Access+ Plans:

Plus, all Access+ plans include the richer Rx Ultra pharmacy network.

With this network upgrade, your small business clients across California can offer their employees even more healthcare provider options, providing them with greater flexibility and choice.

In addition to the full Access+ network, effective July 1, 2023, CCSB is introducing three new popular Blue Shield plans to its portfolio:

All Blue Shield plans through CCSB provide members access to Wellvolution (including Headspace and Ginger), Teladoc Mental Health, Nurse Help 24/7, LifeReferrals 24/7, and the Blue Card program for when members are outside of California.

With the new CCSB bonus program, agents who place new small group business with CCSB from July 1, 2023 – January 1, 2024, can earn up to a $12,000 bonus per group, in addition to competitive commissions. To qualify for the first bonus tier of $1,000, agencies must submit a minimum of three groups with four enrolled employees. Best of all, the bonus is per group with no maximum number of groups! Download the flyer for details.

In addition to California’s most comprehensive access to doctors and hospitals, CCSB health plans offer choice and control, with:

As a trusted CCSB partner since its 2014 launch, we are a top-producing general agency in our sales territory. From agent certification and quoting to assessing new group eligibility and resolving post-enrollment issues, our CCSB experts will provide guidance and support every step of the way.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

With the newly added Blue Shield plans, Covered California for Small Business (CCSB) provides even more options for enrollees.

All Blue Shield plans through CCSB provide members access to Wellvolution (including Headspace and Ginger), Teladoc Mental Health, Nurse Help 24/7, LifeReferrals 24/7, and the Blue Card program for when members are outside of California.

With the new CCSB ‘A Partnership That Pays’ bonus, agents who place new small group business with CCSB from July 1, 2023 – January 1, 2024, can earn up to a $12,000 bonus per group, in addition to competitive commissions. To qualify for the first bonus tier of $1,000, agencies must submit a minimum of three groups with four enrolled employees. Best of all, the bonus is per group with no maximum number of groups! Download the flyer for details.

In addition to California’s most comprehensive access to doctors and hospitals, CCSB health plans offer choice and control, with:

As a trusted CCSB partner since its 2014 launch, we are a top-producing general agency in our sales territory. From agent certification and quoting to assessing new group eligibility and resolving post-enrollment issues, our CCSB experts will provide guidance and support every step of the way.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

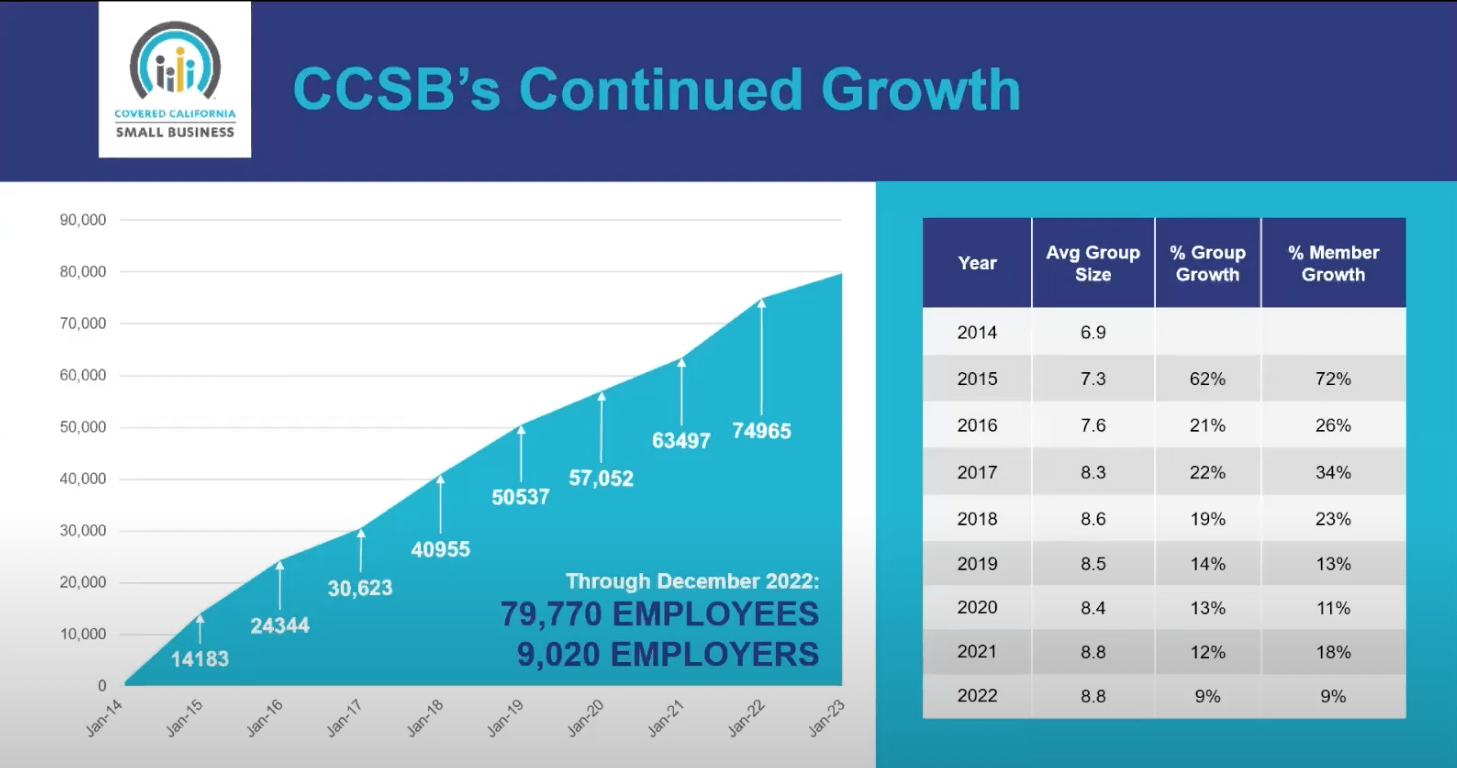

With over 9,020 employers and 79,770 employees enrolled as of December 2022, Covered California for Small Business (CCSB) continues to be a popular health insurance choice for small businesses. In fact, membership has grown significantly over the last few years:

CCSB is introducing the following new Blue Shield plans for Q3-2023 (effective July 1, 2023):

All Blue Shield plans through CCSB provide access to Wellvolution, Teladoc Mental Health, Nurse Help 24/7, LifeReferrals 24/7, and the Blue Card program for members outside of California.

With the new CCSB ‘A Partnership That Pays’ bonus, agents who place new small group business with CCSB from July 1, 2023 – January 1, 2024, can earn up to a $12,000 bonus per group, in addition to competitive commissions. To qualify for the first bonus tier of $1,000, agencies must submit a minimum of three groups with four enrolled employees. Best of all, the bonus is per group with no maximum number of groups! Download the flyer for details.

View the March 28th broker webinar and download the Q&As to learn about CCSB’s growth, advantages for brokers and employers, and the latest carrier offerings.

In addition to California’s most comprehensive access to doctors and hospitals, CCSB health plans offer choice and control, with:

As a trusted CCSB partner since its 2014 launch, we are a top-producing general agency in our sales territory. From agent certification and quoting to assessing new group eligibility and resolving post-enrollment issues, our CCSB experts will provide guidance and support every step of the way.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.