To access the carrier product and rate information provided by PRISM, check the box below indicating you have read and agree to the license agreement. A button will then appear to access PRISM.

This site uses cookies to track your agreement option. If the terms of the license agreement change or if you clear the cookies from your browser, this page will appear once again during the PRISM login process.

New Cigna + Oscar (C+O) small group sales and renewals will not be offered in 2025. At C+O’s request, all plans and rates have been removed from the quote engine. However, you can still quote or renew your C+O groups through December 15, 2024 by contacting us at quotes@claremontcompanies.com or 800.696.4543. Please note: the last day of coverage will be December 14, 2025.

For assistance, please contact our Quotes team at quotes@claremontcompanies.com or 800.696.4543.

Login To PrismCHOICE Administrators has amended the CaliforniaChoice and ChoiceBuilder Agent Agreement. The revisions are listed below.

To avoid any commission payment interruptions, please sign and return the Agent Agreement Amendment as soon as possible to commissions@calchoice.com or fax it to 714.908.3519.

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

The IRS announced* 2022 inflation-adjusted amounts for Health Savings Accounts (HSAs), HSA-qualified High Deductible Health Plans (HDHPs), and accepted benefit Health Reimbursement Arrangements (HRAs).

The 2022 HSA contribution limits and catch-up contributions, and HDHP minimum deductibles and out-of-pocket amounts are listed in the chart below.

To learn what is eligible with your FSA and HSA plans, check out Sterling Administration’s partner – the HSA Store and FSA Store. It’s an easy-to-use online shopping platform that offers 24/7 chat and online help.

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

CHOICE Administrators has provided updated COBRA (Federal) and Cal-COBRA premium subsidy information regarding The American Rescue Plan Act of 2021 (ARPA).

Updates and Notice of AEI Form:

Your groups should review the updates and submit the completed Notice of AEI Form (for those who opted into the COBRA Subsidy) by June 14, 2021 to COBRA-APRA@calchoice.com or fax it to 714.908.3549.

Additional information will be provided when it becomes available.

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Last week the IRS published guidance on the COBRA Subsidy introduced in the American Rescue Plan Act. BRI has produced a summary of the guidance to help employers, brokers, and administrators better understand and manage the subsidy.

To learn more, visit the U.S. Department of Labor (DOL) Employee Benefits Security Administration and the U.S. Department of Health & Human Services (HHS).

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

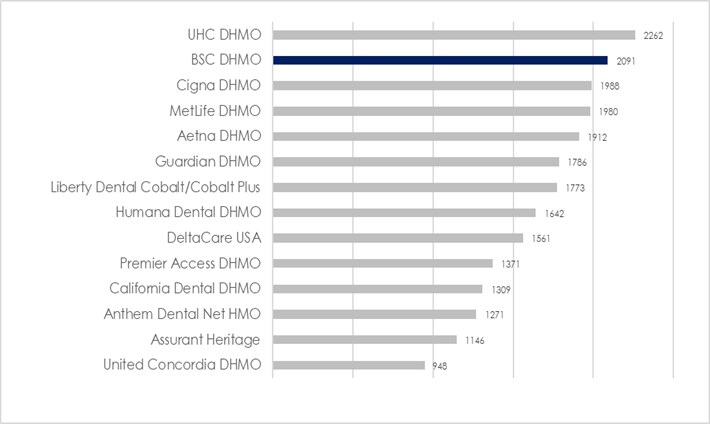

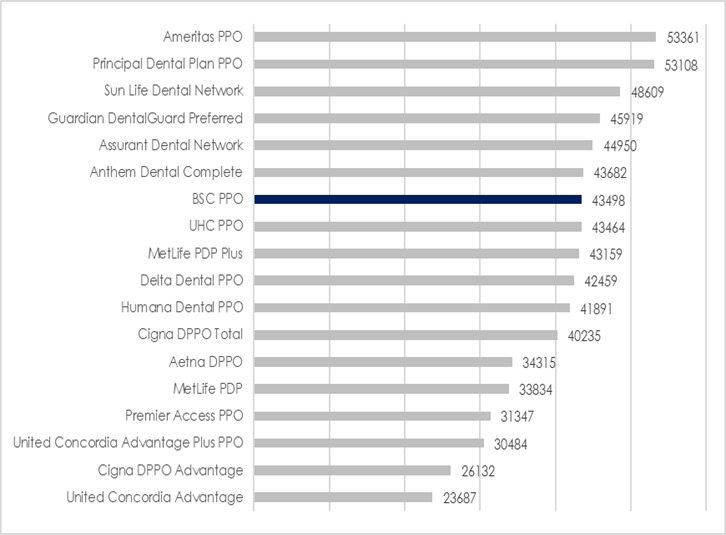

An important factor to consider when recommending dental coverage options to a client is network strength. A large network minimizes disruption of care and increases member satisfaction. It also maximizes the value of your clients’ plans by giving members access to in-network provider negotiated rates, resulting in significant savings.

With Blue Shield, your clients get access to one of the largest dental HMO and PPO networks in California and nationwide. What’s more, small groups that bundle medical and dental coverage get a 10% discount off of their dental premiums, while large groups (101-1,000 employees) receive a 2% discount off of Blue Shield medical rates. Plus Blue Shield Dental plans now come with a two-year rate guarantee.

Blue Shield’s Dental Network

Learn about all the Blue Shield Dental plans and benefits.

1Figures are for unique locations based on April 2021 Network 360 data.

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

Earn more with Cigna + Oscar’s $10,000 mega bonus for California groups with 50-100 enrolled employees. Effective dates from April 1, 2021 to July 15, 2021 are eligible for this program. Get the details.

With Cigna + Oscar, your groups get quality care and all of these (EPO) plan features:

With rates comparable to Kaiser, and networks that include UCSF, Stanford, and Sutter, Cigna + Oscar brings together the power of Cigna’s nationwide and local provider networks, and Oscar’s member-focused tech-driven experience, to deliver small group health insurance that understands the unique needs of California small businesses and their employees.

To learn more about Cigna + Oscar, view our recorded webinar and web page.

Note: Only licensed and appointed agents who are contracted with Cigna + Oscar are eligible for the bonus. Check out the Cigna + Oscar Appointments Guide for full instructions.

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

To fuel your sales efforts, Delta Dental has announced a new broker rewards program with incentives to retain business and gain new Delta Dental clients. This new rewards program is for brokers who sell Delta Dental’s small group plans, including plans from their new Small Business Program portfolio – effective dates beginning January 1, 2021 through December 31, 2021.

Retention Sales Bonus

Retain at least 90% of your book of business through 2021 and earn a bonus on your existing business and qualify for new sales rewards. The more you retain, the more you earn.

New Sales Bonus

Once you’ve met your retention goal, there are three levels of sales rewards. New sales bonuses are based on the number of new groups or total new premium received. And this rewards program is in addition to your existing standard small business commission.

You’ll be automatically enrolled with your first sale. To learn more, download the flyer.

Delta Dental New Broker Rewards Program

To easily measure your success and gauge the status of your eligible small business groups, simply register now on the Small Business Rewards Program dashboard and start tracking your rewards earnings.

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

We’re excited to be an exhibitor at the upcoming Ease EIC21 — the digital conference for growing agencies.

During this free two-day event, get impactful content and actionable takeaways not found anywhere else. Plus, hear from the industry’s foremost thought leaders, paired with members from the Ease leadership team, to learn unique insights and strategies that will help you innovate, grow revenue, and increase customer service.

What to Expect

Event Details

Questions?

Contact our small group experts at 800.696.4543 or info@claremontcompanies.com.

Designed to offer choice, quality, and flexibility, Blue Shield’s Tandem PPO plans are a great option for employers and employees looking to lower healthcare costs without sacrificing the advantages of PPO choice and flexibility.

Included with Tandem PPO Plans and Not Full PPO Plans:

Additional Tandem PPO Benefits:

*Effective with new or renewing 2021 plans.

Tandem PPO

Offers care on your own terms with more programs and features.

Full PPO Network

Offers a larger network of doctors and hospitals with great benefits.

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

Learn about the American Rescue Plan Act’s (ARPA) unprecedented federal government subsidy of 100% of COBRA premiums, employers’ compliance responsibilities, and qualified beneficiary eligibility. And get an overview of the steps BASIC is taking to keep clients in compliance. You’ll also get a synopsis of BASIC’s COBRA Administration.

No CE credits are available. Register now.

To learn more, check out the BASIC website and contact us at 800.696.4543 or info@claremontcompanies.com for assistance when you’re ready to enroll a group in a BASIC plan.

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.