To access the carrier product and rate information provided by PRISM, check the box below indicating you have read and agree to the license agreement. A button will then appear to access PRISM.

This site uses cookies to track your agreement option. If the terms of the license agreement change or if you clear the cookies from your browser, this page will appear once again during the PRISM login process.

New Cigna + Oscar (C+O) small group sales and renewals will not be offered in 2025. At C+O’s request, all plans and rates have been removed from the quote engine. However, you can still quote or renew your C+O groups through December 15, 2024 by contacting us at quotes@claremontcompanies.com or 800.696.4543. Please note: the last day of coverage will be December 14, 2025.

For assistance, please contact our Quotes team at quotes@claremontcompanies.com or 800.696.4543.

Login To PrismHR outsourcing has become increasingly important as employers seek ways to reduce administration time and resources spent, so they can focus on more strategic activities to grow their business.

In addition to saving costs, HR outsourcing can:

Managing employees today is complex and requires specialized knowledge to avoid legal issues and penalties for noncompliance. Most small business owners without a human resources department don’t have that knowledge, don’t maintain the proper employee paperwork, or don’t have effective policies for managing staff. Not only do these gaps in knowledge create risk for the company and cost money, but they also mean that business owners spend more time than necessary on these tasks.

Mid-size companies that do have a human resources department may also feel the pressure to reduce expenses and hand off administrative and compliance-related functions. In either case, BASIC’s HR Assist Lite service offers one-stop HR outsourcing solutions to help both small and mid-size businesses.

Offers employers access to a full suite of tools to help with managing all things human resources including Unlimited Ask the Pro, a feature of HR On-Demand.

Unlimited Ask the Pro

Allows employers to ask a team of certified HR Advisors unlimited questions, online or over the phone. Topics range from sick leave policies to hiring, terminations, employee relations, and the Affordable Care Act.

HR Assist Lite gives small and mid-size businesses the essential expertise, technology, and tools they need to streamline their human resources department, eliminate the stress and time spent on tedious workforce management, stay compliant and protected, and effectively compete in today’s business environment.

Offer your employers, with or without a dedicated HR Department, the invaluable benefit of HR outsourcing.

To learn more, check out the BASIC website and contact us at 800.696.4543 or info@claremontcompanies.com for assistance when you’re ready to enroll a group in a BASIC plan.

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Quote and renew groups early with Cigna + Oscar’s (C+O) Q4 rate pass and competitive plans, and take advantage of their Broker Bonus Program. When groups switch to C+O, they can easily move carriers (even off-cycle) with deductible and out-of-pocket maximum credits. Plus C+O can be written alongside any carrier and plan type with 3+ enrolled.

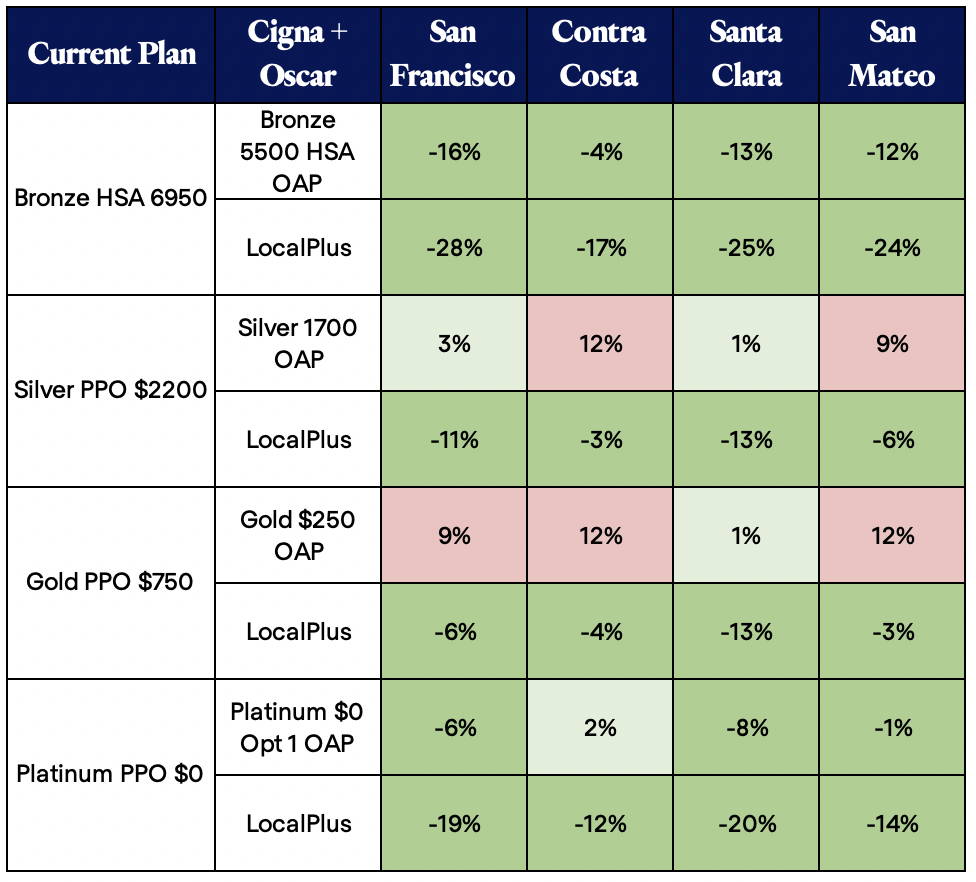

In Northern California, C+O offers competitive Platinum plans with top-tier benefits and affordable Bronze plans with lower member premiums and deductibles. Check out the savings in the chart below.

Earn a $350 bonus for every Cigna + Oscar group with four or more enrolled employees. Effective dates from April 1, 2021 to December 15, 2021 are eligible. Learn more.

With Cigna + Oscar, your groups get quality care and all of these (EPO) plan features:

With rates comparable to Kaiser, and networks that include UCSF, Stanford, and Sutter, Cigna + Oscar brings together the power of Cigna’s nationwide and local provider networks, and Oscar’s member-focused tech-driven experience, to deliver small group health insurance that understands the unique needs of California small businesses and their employees.

To learn more about Cigna + Oscar, download the Northern California and Southern California LocalPlus® network flyers, and view our recorded webinar and web page.

Note: to enroll your groups, you will need to have an appointment with Cigna. Check out the Cigna + Oscar Appointments Guide for full instructions.

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

To meet the evolving needs of employers, Blue Shield of California is broadening its plans to provide more options at lower costs, including medical and behavioral health Teladoc benefits at no charge. They are also updating their Specialty portfolio and pharmacy programs.

Plus, your clients can enjoy rate guarantees and discounts of up to 3% when they add dental, vision, and life coverage with the Benefits Solutions Discount.

Visit Blue Shield of CA to learn about all the available plans.

To compare year over year plan changes, visit Blue Shield of CA.

With more emphasis on health and wellbeing as we emerge from COVID-19, there’s never been a better time to bundle dental, vision, and life benefits with Blue Shield medical plans. Your clients can enjoy a streamlined sales process, rate guarantees, discounts of up to 3% with the Benefits Solutions Discount, and some of the largest networks of dental and vision providers. Learn more about Blue Shield’s dental and vision plan options.

Summary of Benefits (SOBs) documents will be used as both pre-and post-sale materials for 2022.

All changes will be effective upon group renewal.

Copay Card Accumulator Program

When a member uses a non-financial needs-based manufacturer copay card at CVS Specialty Pharmacy, only the member’s true out-of-pocket costs will apply to their deductible and/or out-of-pocket maximum. Impacted members using copay cards at CVS Specialty Pharmacy will be notified via mail approximately 60 days in advance of their plan renewal.

90-Day Supplies at Retail Pharmacies

Coverage for infertility-related drugs

Employers (101-1,000 eligible employees) can save up to 3% on medical premiums when they add dental, vision, and life insurance plans to their Blue Shield medical coverage. The more they add, the more they save:

Download the flyer for details.

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

While COVID-19 has pushed many companies to offer greater flexibility around where employees work, more adaptation is required to meet the needs of today’s evolving workforce. Companies must consider not just a hybrid or fully remote work model, but also their benefits package.

With home, health, and work stress mounting, employees want more support from their employers to manage the changes and stress from COVID-19. By providing that support and enhancing benefits packages with Specialty Accounts, employers can better meet the employees’ needs, attract and retain talent, and drive business recovery.

Cover Employee Work Essentials

Design an Alternate Commuter Benefit Program

With fewer employees commuting every day, switching to a flexible benefits provider can be beneficial with a hybrid work model. Or use a Specialty Account to cover other commuting-related expenses.

Specialty Account plan options outside the scope of a pre-tax commuter benefits plan:

Wellness/Well-Being

Wellness Accounts are one of the most popular Specialty Account programs, and for a good reason: a healthy workforce = reduced medical costs and higher productivity. Consider expanding beyond the standard gym/fitness reimbursement. Create a general well-being account and cover:

Meal Services

Having everyone in the office makes it easy to treat employees to something delicious. Whether it’s early-morning breakfast, sweet treats, or a full catered lunch, it’s a great way to show employees you care.

With meal delivery services, employees can choose what they want to eat and from whom. Here are some options:

Adapting to the changing workforce can be easy with Specialty Accounts. To learn more, visit Benefit Resource Inc.

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Below are the CaliforniaChoice benefit changes effective July 1, 2021:

UnitedHealthcare Silver HMO G

Anthem Blue Cross

Note: the above changes do not affect the initial or enrollment quote, renewal quote, or employee renewal enrollment worksheet. This information will also be sent to all July through August 2021 new and renewing groups.

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Available on both the Tandem PPO and Full PPO networks, the new Silver PPO 2225/50 medical plan provides added support and reduced costs.

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

On June 17, 2021, the US Supreme Court declined to overturn the Affordable Care Act by a 7-2 vote, rejecting a lawsuit filed by a group of Republican state attorneys general claiming that a change made by Congress in 2017 had rendered the entire law unconstitutional.

It’s the third time since 2010 that the Affordable Care Act (ACA), known as Obamacare, has survived a challenge, allowing millions to keep their insurance coverage amid the coronavirus pandemic.

This decision reversed a lower court ruling finding the individual mandate unconstitutional. However, the court did not address the question of whether a key provision in the law was unconstitutional and whether the bulk of the law could stand without a provision that initially required most Americans to obtain insurance or pay a penalty. Instead, the court held the plaintiffs do not have standing in the case, or a legal right to bring the suit.

President Joe Biden tweeted that the decision is “a big win for the American people.” Health and Human Services Secretary Xavier Becerra, who helped write the law as a member of Congress and now is responsible for implementing it, said the decision “means that all Americans continue to have a right to access affordable care, free of discrimination. More than 133 million people with preexisting conditions, like cancer, asthma or diabetes, can have peace of mind knowing that the health protections they rely on are safe.”

Millions of Americans (including nearly 6 million Californians) gained health insurance coverage as a result of the ACA, President Barack Obama’s landmark law passed in 2010. Hundreds of millions more have had their health care and coverage affected by provisions as wide-ranging as changes in Medicare drug copayments, requirements for calorie counts on menus, a pathway for approval of generic copies of expensive biologic drugs, protections for people with preexisting conditions, and a ban on lifetime caps on coverage.

The ACA, has been the subject of unrelenting Republican opposition. But Congressional attempts to repeal it have failed as well. The latest challenge threatened to undo coverage gains under the law that helped drive down the uninsured rate to a record low. Since enacted 11 years ago, the law has gained popularity and reshaped virtually every corner of American healthcare.

Former President Barack Obama tweeted “This ruling reaffirms what we have long known to be true: the Affordable Care Act is here to stay.”

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Earn points for every sale that qualifies for Blue Shield’s new Small Business Incentive Program (June 2021 to January 2022 effective dates) and other broker bonus programs. Then redeem your points for rewards from hundreds of great options, such as gift cards, electronics, products for your home, and more. Or convert your points to cash with a Visa gift card. Best of all, there are no complicated tiers or calculations required!

You Can Earn

With the just-launched Producer Rewards points-based bonus program, each point is equal to one dollar. Plus it’s easy to keep track of your point status and what you’ve earned.

Learn more about the Small Business Incentive Program and Producer Rewards Program. Enroll in the Blue Shield Producer Rewards Program today.

Groups written through Claremont are eligible for this program.

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

In today’s benefits environment, employers are looking for ways to support their employees’ financial and emotional well-being. MetLife Legal Plans can help your clients address this challenge.

With MetLife Legal Plans Your Groups Will Get:

MetLife Legal Plans provide affordable and convenient legal services that add value — enhancing the competitiveness of the group’s benefits program, help recruit and retain talent, support employees’ financial and emotional well-being, and increase productivity.

When you place the MetLife application (for groups with 10-99 employees) through Claremont, your group can get a 5% discount on dental rates with just one employee enrolling in MetLaw. Some employers even pay for the MetLaw subscription for key employees in order to gain the 5% dental savings.

Questions?

Contact your Claremont team at 800.696.4543 or info@claremontcompanies.com.

Available to groups with 2 to 19 lives, the RSL SmartChoice® Small Group package offers comprehensive, flexible plan designs and standalone products incorporating STD, LTD, Life/AD&D, Dental/Eye Care, Critical Illness and Accident Insurance.

Learn more about RSL SmartChoice Small Group insurance products.

Join Reliance Standard at the luxurious La Fonda on The Plaza in Santa Fe, New Mexico on May 10-13, 2022. To qualify for an invitation, write enough SmartChoice business from January 1, 2021 through December 31, 2021 to generate 70 points per the Production Qualification Point System.

For each additional 40 points your team generates, an additional invitation will be granted. Learn more about the conference and Production Qualification Point System.

Questions?

Contact the small group experts at 800.696.4543 or info@claremontcompanies.com.