To access the carrier product and rate information provided by PRISM, check the box below indicating you have read and agree to the license agreement. A button will then appear to access PRISM.

This site uses cookies to track your agreement option. If the terms of the license agreement change or if you clear the cookies from your browser, this page will appear once again during the PRISM login process.

New Cigna + Oscar (C+O) small group sales and renewals will not be offered in 2025. At C+O’s request, all plans and rates have been removed from the quote engine. However, you can still quote or renew your C+O groups through December 15, 2024 by contacting us at quotes@claremontcompanies.com or 800.696.4543. Please note: the last day of coverage will be December 14, 2025.

For assistance, please contact our Quotes team at quotes@claremontcompanies.com or 800.696.4543.

Login To PrismEffective September 1, 2022, rates on RSL SmartChoice® STD, LTD, and Group Life new business have been reduced by 10%. Plus, there’s no fee for online billing through their portal. What’s more, your clients will get these free value added services:

Download the Value Added Services flyer to learn more.

Available to groups with 2 to 19 lives, the RSL SmartChoice® Small Group package offers comprehensive, flexible plan designs and standalone products incorporating STD, LTD, Life/AD&D, Dental/Eye Care, Critical Illness, and Accident Insurance.

Plus, earn more when you sell RSL SmartChoice with Reliance Standard’s Premier Producer Program.

Learn more about RSL SmartChoice Small Group insurance products.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

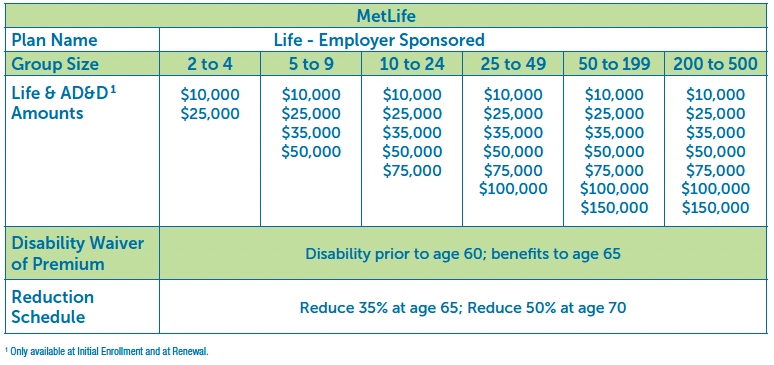

With the addition of a new life plan from MetLife (effective December 1, 2022), ChoiceBuilder® now offers your clients two life carriers to choose from.

Available to small businesses (2-500 employees), ChoiceBuilder is the best ancillary exchange in California, offering the nation’s premier dental, vision, chiropractic/acupuncture, and life insurance benefits in a single easy-to-manage program – with both employer-sponsored and voluntary coverage options. Plus, ChoiceBuilder can be offered alongside any medical plan, including CaliforniaChoice®.

It’s a great way to enhance your clients’ employee benefits package without the high cost of additional benefits or the difficulties of managing different services. There’s one application, one bill, and one point of contact for administration.

With more than 8,000 employers and 130,000 members across the state, ChoiceBuilder offers freedom, simplicity, and affordability.

Dental, Vision, Chiropractic and Life Carriers

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

California’s unemployment rate fell to 3.9% in July, its lowest since 1976 and one of the lowest rates on record. This figure, published by California’s Employment Development Department, is a reminder that the labor market remains very tight throughout the state.

In addition to job gains across California, employees today have many options of where to work. Providing comprehensive health benefits are key to helping employers recruit and retain talent. Therefore, at your clients’ next renewal, advise them on how to implement a competitive health benefits program to maintain their workforce.

To learn more about the California labor market, read this KQED article.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Join Blue Shield’s annual Broker Roadshow for an online preview of their 2023 small business portfolio which offers dependable, affordable, quality coverage and benefits.

Register to Attend One of The Two Roadshows:

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

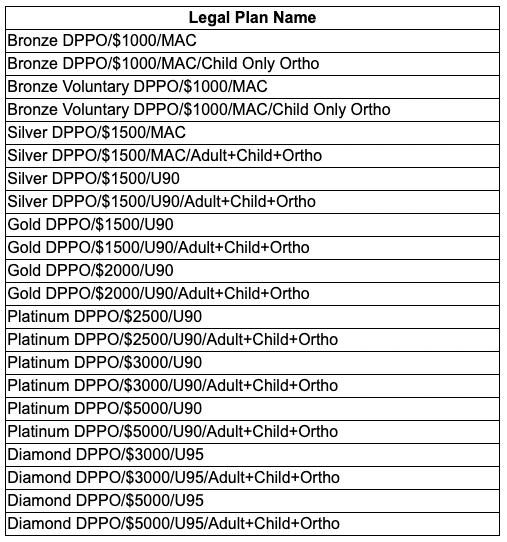

Blue Shield has announced an average 15% rate reduction for Bronze, Silver, and Gold plans for 1-50 groups, and an average 10% rate reduction for 51-100 groups in Q4 2022. The rate reduction does not apply to Platinum and Diamond tier plans.

And to provide your clients with easy-to-understand options, 22 new DPPO plans were introduced in January 2022. The plans (listed below) are in five categories, mirroring the naming convention of medical plans: Bronze/Bronze Voluntary, Silver, Gold, Platinum, and Diamond. Plus, there’s now more flexible member access to the dental cleaning benefits included in their plans. Instead of the previously allowed one cleaning in a 6-month period, as of January 2022, members are eligible for two cleanings in a consecutive 12-month period.

To learn more, check out the Blue Shield Specialty Sales Guide. Rates for marketed and closed dental plans can be viewed on Broker Connection.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

The Inflation Reduction Act of 2022 (IRA) was signed into law by President Biden on August 16, 2022. While group health benefits are not directly impacted, health insurance professionals will want to be aware of several healthcare and health insurance provisions in the bill.

Increased premium tax credits for low-income individuals, which were implemented in the 2021 American Rescue Plan Act, were set to expire at the end of 2022. IRA extends the increased premium subsidies through 2025.

Prescription Drug Price Negotiation by Medicare

IRA allows for the first time the Centers for Medicare & Medicaid Services (CMS) to negotiate drug prices under Medicare Parts B & D.

$2,000 Annual Cap on Medicare Part D

IRA places a $2,000 annual cap on out-of-pocket costs for prescription drugs under Medicare Part D, starting in 2025.

Penalties if Drug Companies Increase Prices Faster Than Inflation

IRA places inflation caps in Medicare Part D that limit price increases for drugs year over year. Tax penalties will be levied on drugmakers that increase the prices of their products more than the rate of inflation.

$35 Out-of-Pocket Cost Limit on Insulin

IRA places a $35 out-of-pocket cost limit on insulin for individuals under Medicare.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

With simple and clear underwriting rules, Cigna + Oscar (C+O) makes it easy for you to understand which of your clients are eligible for their plans. And the C+O rules are designed to make it easy for employers and employees to choose the coverage that best meets their needs.

With Cigna + Oscar, your groups get quality care and all of these (EPO) plan features:

With rates comparable to Kaiser, and networks that include Dignity Health, UCSF, Stanford, and Sutter, Cigna + Oscar brings together the power of Cigna’s nationwide and local provider networks, and Oscar’s member-focused tech-driven experience, to deliver small group health insurance that meets the unique needs of California small businesses and their employees. To learn more about Cigna + Oscar, view our web page.

Note: to enroll your groups, you will need to have an appointment with Cigna. Check out the Cigna + Oscar Appointments Guide for full instructions.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Educate your clients about the advantages of vision benefits for eye health and safety, and controlling healthcare costs with the early detection of chronic or life-threatening conditions like heart disease, stroke, diabetes, high blood pressure, or even cancer.

A popular option for small businesses, VSP Choice provides quality vision benefits including an annual WellVision Exam® and annual prescription lenses.

The VSP Choice provider network includes thousands of professionally certified optometrists and ophthalmologists who offer comprehensive vision exams and ways to purchase glasses or contacts in office. Best of all, members have the freedom to choose from both in- and out-of-network vision providers (out-of-network costs are usually higher).

Value-Add Benefits

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Currently, your clients may be experiencing tighter than expected budgets due to economic uncertainty, inflation, and rising interest rates. Fortunately, DeltaCare® USA plans offer full-featured benefits and affordable, predictable prices – perfect for groups looking to save money without sacrificing coverage.

In addition to lower costs, DeltaCare USA (HMO-type) plans provide a broad range of coverage including:

DeltaCare USA plans also offer an added bonus for employees who have begun, but not completed, an orthodontic procedure. In-progress provisions allow new members to continue treatment with their current orthodontist ― even if that orthodontist isn’t in the DeltaCare USA network.

DeltaCare USA plans also include:

As a fixed copayment plan, DeltaCare USA offers employees convenience and simplicity with:

Plan members select a primary care dentist from the DeltaCare USA network and pay set copayments for covered services directly to that dentist. This dentist provides most of the treatment and coordinates any necessary specialist referrals. Best of all, there’s no paperwork to fill out. Visit Delta Dental to learn more.

With DeltaCare USA plans, your clients can help their employees stay healthy and save money!

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Blue Shield has announced the dates for their Q1-2023 Broker Roadshow:

An official invitation will follow soon. Mark your calendars!

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.