To access the carrier product and rate information provided by PRISM, check the box below indicating you have read and agree to the license agreement. A button will then appear to access PRISM.

This site uses cookies to track your agreement option. If the terms of the license agreement change or if you clear the cookies from your browser, this page will appear once again during the PRISM login process.

New Cigna + Oscar (C+O) small group sales and renewals will not be offered in 2025. At C+O’s request, all plans and rates have been removed from the quote engine. However, you can still quote or renew your C+O groups through December 15, 2024 by contacting us at quotes@claremontcompanies.com or 800.696.4543. Please note: the last day of coverage will be December 14, 2025.

For assistance, please contact our Quotes team at quotes@claremontcompanies.com or 800.696.4543.

Login To PrismEffective January 1, 2023, Blue Shield Trio is expanding to 27 total zip codes in Monterey County through a new ACO partnership with Aspire Health.

Covered communities will include Marina, Monterey, Pacific Grove, Pebble Beach, Seaside, Big Sur, Carmel Valley, Castroville, Chualar, Gonzales, Moss Landing, Salinas, Soledad, and Spreckels.

View the webinar recording (passcode: a0!@&LX7), and download the presentation slides and Trio HMO Monterey brochure.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

The IRS has announced the annual plan contribution limits for Flexible Spending Accounts (FSA), Health Savings Accounts (HSA), commuter benefit plans, and adoption assistance programs. For a summary of the 2023 inflation-adjusted amounts and plan limits, check out BRI’s overview by plan type and access the IRS official announcements.

*Includes limited purpose FSAs that are restricted to dental and vision care services, which can be used in tandem with HSAs.

To learn more visit Benefit Resource (BRI) and SHRM.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

On October 11, 2022, the Internal Revenue Service (IRS) announced updated rules designed to fix the Affordable Care Act (ACA) “Family Glitch.” The change impacts family health coverage options for hundreds of thousands of lower-income Californians currently enrolled in group family coverage. The updated rules come into effect for 2023 coverage. As you conduct open enrollment meetings with your clients, you will likely get questions from employees, so you’ll want to familiarize yourself with the updated rules.

The updated rules change how premium tax credit (subsidy) eligibility is calculated for families on the ACA individual marketplaces (Covered California for California residents). Currently, if a family member has employer coverage, subsidy eligibility for the other family members is calculated based on the affordability of the employee coverage, not the affordability of the family coverage. This is often a big difference, because employer premium contribution is often less for family coverage compared to employee coverage. The updated rules change that calculation. Now, for 2023 coverage onwards, if a family member has employer coverage, the Covered California subsidy eligibility calculation for the other family members is based on the affordability of the family coverage. It is expected that many family members currently enrolled in family coverage in group plans will now be eligible for Covered California individual coverage subsidies, which creates an additional factor in their decision on whether to enroll in the group plan.

The updated rules do not affect employer liability under the ACA large employer mandate.

Employers with non-calendar year plans, including health reimbursement arrangements (HRAs), and Section 125 cafeteria plans, will want to review how the updated rules impact family member ability to disenroll mid-plan year.

For more information, check out the resources below.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Below are the Cigna + Oscar (C+O) Q1-2023 plan and rate changes. To learn more about the first quarter updates, join the C+O October 20th webinar.

Northern CA

Southern CA

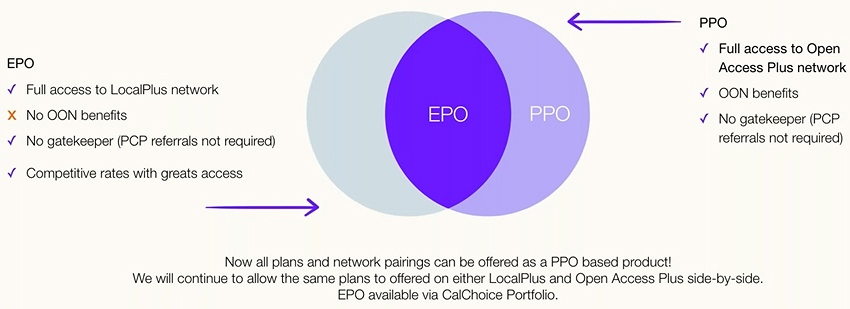

Approximately two-thirds of the membership are enrolled on an Open Access Plus Network offering.

National Network Enhancements

Expanding PPO Products with LocalPlus – Effective January 1, 2023

Double-Digit Savings Across The State

Two new Bronze plans added: Bronze $3,000 and Bronze $7,250.

Earn up to $100/year by downloading the C+O mobile app and syncing steps.

C+O is the only carrier that will credit both deductible and max out-of-pocket amounts for the current calendar year.

Download the Provider FAQs to learn more.

This Q4, earn a bonus for writing multiple groups with December 1, 2022, December 15, 2022, and January 1, 2023 effective dates.

Download the Cigna + Oscar Bonus Program flyer for details.

With rates comparable to Kaiser, and networks that include Dignity Health, UCSF, Stanford, and Sutter, Cigna + Oscar brings together the power of Cigna’s nationwide and local provider networks, and Oscar’s member-focused tech-driven experience, to deliver small group health insurance that meets the unique needs of California small businesses and their employees. To learn more about Cigna + Oscar, view our web page.

Note: Only licensed and appointed agents who are contracted with Cigna + Oscar are eligible for the bonus. Check out the Cigna + Oscar Appointments Guide for full instructions.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Earn a Kaiser Permanente $100 bonus, per enrolled subscriber, when you sell new small group business through CaliforniaChoice or Covered California for Small Business (CCSB), December 1, 2022 – January 1, 2023 effective dates.

This bonus is on top of your regular commission and standard broker reward programs such as the Total Replacement and Group Production rewards. Download the flyer to learn more.

Kaiser Permanente Broker Bonus

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

If you missed the recent Blue Shield of CA Q1-2023 Small Business Broker Roadshow, view the recording (password: Blue123!), presentation slides, and Q&A.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Below are the Q1-2023 updates announced by Blue Shield of California. Make sure to enroll and take advantage of the Small Business Incentive Program and the Renewal Rewards Program.

To help support your open enrollment meetings, learn about Blue Shield’s broker-friendly digital tools.

Eight new dental PPO plans will be added:

Blue Shield members have access to Teladoc’s national network of U.S. board-certified physicians. Teladoc medical doctors are available 24/7/365 by phone or video. Get the details.

Extended through December 31, 2023. Learn more.

If you missed the recent Blue Shield of CA Q1-2023 Small Business Broker Roadshow, view the recording (password: Blue123!), presentation slides, and Q&A.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

For groups with two to 99 employees, the Delta Dental Small Business Program (SBP) offers a wide variety of plans and options, all with comprehensive coverage and easy access to quality care and savings from their large networks. These plans are designed to be flexible so that your small business clients can choose the options that make the most sense for their business and budget. Here is what’s new for 2023!

The leaner Core 201 plan replaces the Core 200 plan and features 100/80/0 coverage with a $750 annual maximum.

Advantage 200 and 400 plans are getting a higher annual maximum of $3,000 and adding orthodontic options for adults and children. These plans offer orthodontics for adults and children with a $1,000 or $1,500 lifetime maximum.

The employer-paid participation requirement for adult orthodontics has dropped from 25 to five employees. With this reduction, more small groups will now be eligible for this optional adult benefit.

Dual Choice 4 features the new Core 201 plan as the low plan and Advantage 200 as the high plan with limited maximum options:

These options have been added to the following plans:

Delta members with any of these conditions are entitled to additional routine and periodontal cleanings. The member must advise their dentist at the time of visit and they can submit a specific note with the electronic billing for payment consideration.

No plan changes for 2023. The 2022 rates will hold for 2023.

Download the Delta Dental Small Business Program brochure to learn more. And explore Delta Dental’s SBP plan comparison.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Beam has announced a two-year rate guarantee on new dental and vision business with 51-499 eligible employees – effective dates from October 1, 2022 to January 1, 2023.

In addition to dental plans with over 400,000 access points nationwide, Beam offers vision, life, disability, accident, and hospital indemnity coverage.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

In addition to robust health plan benefits, Covered California for Small Business (CCSB) carrier partners provide members added incentives to support overall health and wellness. These include valuable discounts and free programs to help members reach their fitness and health goals.

Along with California’s most comprehensive access to doctors and hospitals, CCSB health plans offer choice and control, with:

Claremont has been a trusted CCSB partner since its 2014 launch, and we are the top producing general agency in our sales territory. From agent certification and quoting to assessing new group eligibility and resolving post-enrollment issues, our CCSB experts will provide guidance and support every step of the way.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.