To access the carrier product and rate information provided by PRISM, check the box below indicating you have read and agree to the license agreement. A button will then appear to access PRISM.

This site uses cookies to track your agreement option. If the terms of the license agreement change or if you clear the cookies from your browser, this page will appear once again during the PRISM login process.

New Cigna + Oscar (C+O) small group sales and renewals will not be offered in 2025. At C+O’s request, all plans and rates have been removed from the quote engine. However, you can still quote or renew your C+O groups through December 15, 2024 by contacting us at quotes@claremontcompanies.com or 800.696.4543. Please note: the last day of coverage will be December 14, 2025.

For assistance, please contact our Quotes team at quotes@claremontcompanies.com or 800.696.4543.

Login To PrismWith an expansive network, Humana Vision offers a choice of more than 135,000 provider locations nationwide, including independent providers, retail, and online options (LensCrafters, Pearle Vision, Target Optical, Ray-Ban, Glasses.com, and ContactsDirect.com).

Starting January 1, 2023, Humana’s network will include Walmart® and Sam’s Club™ vision and optical centers. Current and new Humana Vision members can visit Walmart and Sam’s Club vision and optical centers for eyeglass frames, lenses, and contact lenses as part of their in-network vision benefits. Learn more.

Please note: some optometrists with Walmart and Sam’s Club are independent contractors and may not participate in the Humana Vision network for eye care services like exams. Members can use Humana’s “Find an Eye Doctor” tool or call the provider in advance to confirm if the provider is in network.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Please join us in celebrating Chris Kersey and Crystal Nelson on their milestone work anniversaries.

Chris Kersey, Applications Developer, is celebrating 15 years. “Chris always has the needs of our clients and team members front of mind when he is designing and coding,” says Ken Ruotolo, Claremont COO. “Inevitably, Chris will point out something that we hadn’t thought of and then will implement it in a thoughtful, easy-to-use and comprehensive way. I know I speak for all his teammates when I say it is a real pleasure to work with Chris. Congratulations on 15 years of service!”

Crystal Nelson, Broker Service Representative, is celebrating five years. Crystal initially came aboard as a temporary employee but quickly demonstrated that she should be a permanent member of the team. “Our broker customers have nothing but good things to say about Crystal,” says Laura Hogsed, Service Manager. “She is thoughtful, thorough, and goes above and beyond in everything that she does. Crystal is a great example of Claremont’s core values of Thoughtfulness, Innovation, Professionalism, Positivity, and Collaboration. She is truly a joy to work with. Please join me in congratulating Crystal on her five years of great service!”

You can reach Chris at ckersey@claremontcompanies.com or 925.296.8849 and Crystal at crystal@claremontcompanies.com or 925.296.8826.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Effective January 1, 2023, Blue Shield of California Trio HMO and Local Access+ networks will expand in San Diego to include UC San Diego (UCSD) Health.

Not all UCSD Health locations or providers will be in the Trio HMO or Local Access+ networks. Blue Shield recommends using their Find a Doctor tool which has been updated to reflect this network expansion. You can also reference Blue Shield’s Network Comparison Tool for network options in San Diego.

Blue Shield members enrolled in a Trio HMO or Local Access+ plan can select primary care physicians, and gain access to specialists and facilities at these UCSD Health clinics:

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Starting January 1, 2023, a new California law requires most insurance producers, including life, accident and health agents, to include their individual license number on emails. For details, read the Notice from California Insurance Commissioner Ricardo Lara.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Delta Dental PPO™ plan members have access to two Delta Dental networks – Delta Dental PPO and Delta Dental Premier®. Together, they make up the largest network of dentists in the nation, according to Zelis Network360®. In fact, four out of five dentists in the United States are Delta Dental network dentists. The main difference between the two networks is the amount members can save.

There are three options: PPO, Premier, and non-Delta Dental dentists. Members save the most when visiting a Delta Dental PPO dentist, a little less at a Premier dentist, and the least at a non-Delta Dental dentist.

Delta Dental PPO Network

With this large, high-quality and reliable network of dentists, members don’t need to carry paper ID cards or submit claims, since Delta Dental works directly with dentists to manage identification and claims.

By visiting a dentist in the PPO network, members pay less out-of-pocket and make their plan maximum go farther. PPO dentists have agreed to reduced fees, which means added savings and no unexpected out-of-pocket costs.

But members don’t have to sacrifice plan savings if their dentist isn’t in the PPO network.

Delta Dental Premier Network

By visiting a dentist in the Premier network, members can expect the same advantages of a high-quality network and easy access, but with more limited out-of-pocket savings.

Delta Dental Premier dentists have also agreed to discounted fees, as part of their contract with Delta Dental. Premier fees are typically higher than Delta Dental PPO fees. Like with PPO dentists, members won’t pay more than their expected share — so there are no surprise bills.

Non-Delta Dental dentists can set any price they wish.

To encourage in-network visits long term, it’s best to build incentives into plan designs that encourage visiting in-network dentists. Groups may have the following options:

The amount the plan bases its payment on is the reimbursement, also known as the maximum plan allowance. This is separate from the percentage at which certain services are covered.

Under a Delta Dental PPO plan, PPO dentists are reimbursed at PPO fees and Premier dentists are reimbursed at either Premier or PPO fees. How Premier dentists are reimbursed under a PPO plan is up to the plan’s benefits administrator, but there are advantages to each of the two options:

With the Find a Dentist tool, members can check a dentist’s network by entering their own location and choosing their preferred network from the ‘Select a Network’ drop-down menu. Each dentist’s directory listing indicates which networks the dentist participates in.

With Delta Dental’s dual network, your clients and their employees can make informed choices about their care and costs, without sacrificing quality.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

With complex provider networks and competing underwriting requirements of the various carriers in California, selling group health insurance isn’t easy. That’s why CaliforniaChoice, the private exchange with the state’s largest portfolio of plans and networks, has spent 26 years simplifying the employee benefits process so you can focus on building your business.

Medical Partners

You can offer multiple health plans side-by-side in a single employee benefits package. That means you only have to learn one product and run one quote, while still giving your clients the value of choice.

Optional Benefit Partners

Dental, vision, chiropractic, acupuncture, and life benefits that can be bundled in a single package.

Additional Product and Service Partners

Your clients have access to a range of value-added benefits at no extra cost.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

To effectively address your clients’ changing benefits needs and scale your business, MetLife has improved its level of service and support with the following enhancements:

MetLife is dedicating more local resources to bring expertise, support, and know-how where and when it’s needed the most with:

$100 million annual technology investment and continuous service improvement including:

Your groups get the simplicity they desire and their employees get the choice they want with:

MetLife is alleviating administrative burdens with:

Download the MetLife flyer to learn more.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

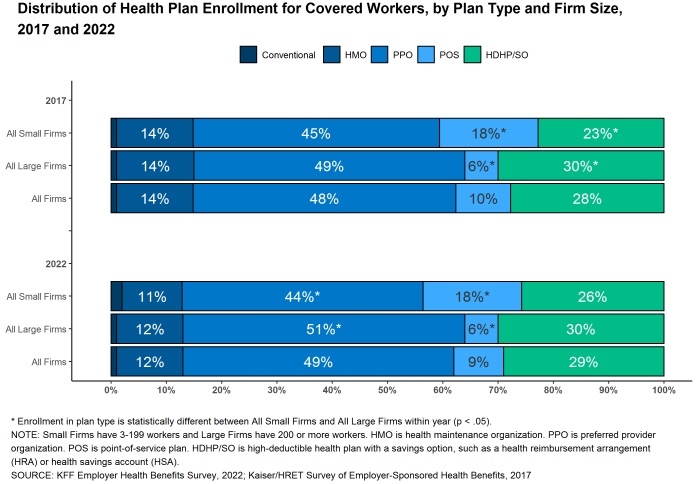

Given today’s tight labor market and rising wages, employers are concerned about the cost of health premiums, especially since recent inflation suggests larger increases are imminent. And as disclosed in the Kaiser Family Foundation (KFF) survey, employers continue to be anxious about meeting the mental health needs of their employees and their dependents.

Conducted from February through July 2022, the KFF 2022 Employer Health Benefits Survey, of 2,188 randomly selected private and non-federal public firms of three or more workers, reveals that workers at small firms pay more in premiums and face higher deductibles than workers at large firms.

In 2022, the average annual premiums for employer-sponsored health insurance are $7,911 for single coverage and $22,463 for family coverage. In contrast to the lack of premium growth in 2022, workers’ wages increased 6.7% and inflation increased 8%.

Check out the KFF 2022 Employer Health Benefits Survey to ensure that you and your clients are up to date with the latest employer-sponsored coverage data. Contact us today to develop tailored benefits solutions that address your clients’ needs.

KFF 2022 Employer Health Benefits Survey

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

Identify new business opportunities and create valuable administrative efficiencies for your firm and for your clients with a block strategy from MetLife.

With a wide range of solutions, service delivery, and focused support, MetLife will help you deliver the most updated contracts, plan designs, and competitive pricing available to each block of business.

Download the MetLife flyer to learn more.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.

The 2023 Small Group Special Enrollment Period (SEP) starts November 15, 2022.

The Small Group SEP is the opportunity for employers to enroll in coverage with a $0 contribution requirement and no minimum participation requirement (at least 1 employee must enroll). The limited application period is from November 15 to December 15, 2022, for coverage effective January 1, 2023. Learn more.

Questions?

Contact The Answer Team at 800.696.4543 or info@claremontcompanies.com.

Get The Latest News with Text Messaging!

Your success is important to us, and we’re actively working on new solutions to support you throughout the year. To get the latest news via text messaging in the future, simply provide your cell phone number here.